财务会计考试代写 Financial Accounting代写 会计代写代考

538Financial Accounting II Mid-term 财务会计考试代写 ADDITIONAL INFORMATION ADDITIONAL INFORMATION 1. The Mid-term has the duration of 90 minutes. 2. Students should have their identi...

View detailsSearch the whole station

会计金融市场代写 FINANCIAL MARKETS (DURATION: 2.5 HOURS plus 30 minutes upload time) This examination paper consists of four sections. All Sections (A, B, C and D)

FINANCIAL MARKETS

(DURATION: 2.5 HOURS plus 30 minutes upload time)

This examination paper consists of four sections.

All Sections (A, B, C and D) are compulsory.

All Section answers should be uploaded via one document to Moodle.

Ensure that the start and end of each question is clearly identifiable.

The use of standard calculators with scientific, and standard arithmetic and statistical functions, is permitted.

The exam is open-book.

1)

If today is Monday 1st February, and I enter into a 2-month forward Foreign Exchange transaction. The value date will be

A) April 3rd

B) April 1st

C) April 2nd

D) March 31st

2)

TimeSmith Corp is in the process of launching an IPO. Last year the company had revenues of $225 million and earnings of $18 million. TimeSmith’s investment bankers would like to estimate the value of the company using comparable companies. The investment bankers have assembled the following data for 5 representative companies in the same industry sector that have recently gone public. In each case the ratios are based on the IPO price.

| Company | Price / Earnings |

| Astra | 22.5 |

| Zenica | 16.2 |

| NiFi | 19.8 |

| Electron | 23.9 |

| Blackberry | 22.8 |

After the IPO, TimeSmith will have 25 million shares outstanding. What would TimeSmith’s IPO price be if it was issued in line with the industry mean?

A) $15.15

B) $16.83

C) $16.30

D) $15.62

A Treasury Inflation-Protected Security (TIPS) has a real coupon rate of 3.5% per annum. An investor purchases $100,000 as soon as the bond is issued. Inflation after 6 months is 3% per annum. Inflation after 12 months is 2% per annum. What dollar amount of coupon will the investor receive at the 12-month period?

A) $1794.01

B) $1750.00

C) $1786.04

D) $1776.25

4)

A Federal Reserve open market purchase of bonds leads to

A) An increase in the banking system’s balance sheet and an increase in the Federal Reserve’s balance sheet

B) No change in the banking system’s balance sheet and no change in the Federal Reserve’s balance sheet

C) An increase in the banking system’s balance sheet and no change in the Federal Reserve’s balance sheet

D) No change in the banking system’s balance sheet and an increase in the Federal Reserve’s balance sheet

5)

The following statements regarding the ‘Yen Carry Trade’ are true EXCEPT

A) The ‘Yen carry trade’ existed when investors borrowed Yen at a low-interest rate then purchase either U.S. dollars or a currency in a country that pays a high interest rate on its bonds

B) The ‘Yen carry trade’ is still a viable investment option versus the US Dollar today

C) Most Japanese high street banks offered the facility for private investors to access foreign currency deposit accounts

D) The ‘Yen carry trade’ ultimately resulted in losses in the wake of 2008 financial crisis as the Yen strengthened in value versus the US Dollar

All of the following are likely to contribute to a mortgage-backed security prepayment EXCEPT

A) a rise in interest rates

B) a natural disaster insurance payment

C) early sale of the property

D) a fall in interest rates

7)

The advantage of forward contracts over futures contracts is that forward contracts

A) are standardised

B) have lower default risk

C) are more liquid

D) are none of the above

8)

Under an Interest Rate Swap agreement Party A agrees to pay Party B periodic interest rate payments of LIBOR + 50 bps in exchange for periodic interest rate payments of 3%. If LIBOR is 2% what is the net payment between the two parties?

A) A receives 2.0% and pays B nothing

B) B receives 2.0% and pays A nothing

C) B receives 0.5% and pays A nothing

D) A receives 0.5% and pays B nothing

All the following are true of the MiFID 2 regulation EXCEPT

A) It may make banks more reluctant to trade securities

B) It has led to an increase in Investment Bank research hiring

C) It has led to increased research revenue for Investment Banks

D) It ensures Buy Side ‘Best Execution’

10)

You pay $963.73 for a 14-day T-bill. It is worth $1,000 at maturity. What is its investment rate?

A) 9.811982%

B) 9.456107%

C) 9.05518%

D) 9.24326%

11)

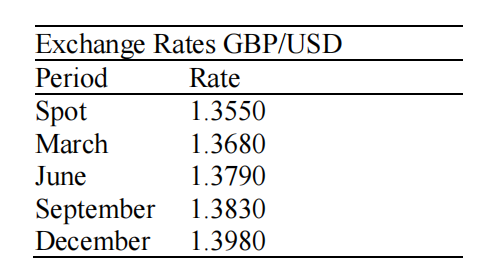

A UK firm knows it is going to receive $400,000 in September. The current spot and future exchange rates are

The UK firm decides to fully hedge the position. When September arrives, the actual exchange rate is GBP/USD rate is 1.3740. How much did the UK firm gain or lose by this strategy?

A) $1,894.50 gain

B) £1,894.50 gain

C) $1,894.50 loss

D) £1,894.50 loss

The Federal Reserve would like to ‘normalise’ interest rates because

A) its debt liabilities are becoming too much of a financial burden

B) too many people can access cheap loans and speculate in the stock market

C) current interest rates leave the Fed with little ‘firepower’

D) the Fed believes it is normal for the market to determine interest rates

13)

(I) The Principal Strip and the Coupon Strip matching the maturity of the bond will likely trade at the same yield

(II) The Principal Strip and the Coupon Strip matching the maturity of the bond will likely trade at the different yields

(III) The Duration of a Zero Coupon bond is the same as the maturity of the bond

A) (I) is true, (II) false, (III) is false.

B) (I) is false, (II) true, (III) is true.

C) (I) is true, (II) false, (III) is true

D) (I) is false, (II) false, (III) true

14)

A bank decides to insure its exposure to a Brazilian government bond and buys a 10-year Brazilian CDS contract on the 30th December 2019 at a CDS spread of 550 bps and for a $15 million notional amount. How much does the bank pay for this protection?

A) A one-off payment of $550,000

B) An annual payment of $550,000

C) An annual payment of $825,000

D) A one-off payment of $825,000

(I) The Federal Reserve has a dual mandate focused on price stability and full employment

(II) The European Central Bank has a dual mandate focused on price stability and full employment

(III) The ‘Beige Book’ is a summary of current economic conditions across the 12 Federal Reserve Districts

A) (I) is true, (II) false, (III) is false

B) (I) is false, (II) true, (III) is true

C) (I) is true, (II) false, (III) is true

D) (I) is false, (II) false, (III) true

16)

Consider a central bank policy to maintain 8.5% reserves on deposits held by commercial banks. A bank, ALFA, currently has $10 million in deposits and holds $875,000 in reserves at the central bank. What is the excess reserve ratio? What will be the requirements if the bank is to add $1,000,000 additional deposits?

A) Excess Reserve Ratio 0% and $30,000 additional reserve requirement

B) Excess Reserve Ratio 0.25% and $60,000 additional reserve requirement

C) Excess Reserve Ratio 0.25% and no additional reserve requirement

D) Excess Reserve Ratio 0% and no additional reserve requirement

17)

Which of the following can be described as involving direct finance?

A) A corporation’s stock is traded in the secondary market

B) A pension fund manager buys commercial paper in the secondary market

C) An insurance company buys shares of common stock in the over-the-counter markets

D) None of the above

Japan has a Debt/GDP ratio of over 200%. The financial markets are

A) Concerned by this and it is likely this could eventually lead to a financial crisis in Japan

B) Concerned by this so it is likely the Yen currency will weaken as a result

C) Unconcerned by this as Japan has promised to reduce this debt level over time

D) Unconcerned by this as most debt is owned by Japanese savers

19)

You, a UK client wish to undertake a Forward foreign exchange transaction buying USD and selling GBP. Interest rates in the UK are 2% lower than in the US.

The current GBP/USD spot rate is 1.3000

What will the approximate 1-year forward rate be?

A) GBP/USD 1.2740

B) GBP/USD 1.3260

C) GBP/USD 1.2840

D) GBP/USD 1.3000 as the interest rate differential payment will be calculated separately

20)

An FX Swap is when

A) One currency is permanently swapped for another

B) Two trades take place with the second being the reverse of the first

C) One currency is swapped with the seller having the right to swap it back in the future

D) Two trades take place with the second one within 3 months of the first

What would be the annualised discount rate % if a Treasury Bill was purchased for $9,650 maturing in 182 days for $10,000?

A) Discount Rate 7.19%

B) Discount Rate 7.02%

C) Discount Rate 7.17%

D) Discount Rate 6.92%

22)

According to the liquidity premium theory of the term structure

A) the interest rate on long-term bonds will equal an average of short-term interest rates that people expect to occur over the life of the long-term bonds plus a liquidity premium

B) buyers of bonds may prefer bonds of one maturity over another, yet interest rates on bonds of different maturities move together over time

C) even with a positive liquidity premium, if future short-term interest rates are expected to fall significantly, then the yield curve will be downward-sloping

D) all of the above

23)

Using a Eurobond 360-day year and 4.75% annual coupon, coupon payment date July 1st and 100,000 face amount, a customer sells a bond with a Settlement Date of 15th October. What is the amount of Accrued Interest due to the customer?

A) $1,470.50

B) $992.63

C) $1,300.15

D) $1,385.42

The relationship between the Prime Rate and the return on commercial paper can be described best by which of the following statements?

A) The Prime Rate has no relationship with the return on commercial paper

B) The Prime Rate is usually a few percentage points higher than the return on commercial paper, and both move up/down in a similar fashion

C) The Prime Rate and the return on commercial paper are usually about the same interest rate

D) Because commercial paper is riskier, returns on commercial paper always exceed the Prime Rate

25)

Preferred stockholders hold a claim on assets that has priority over the claims of

A) both common stockholders and bondholders

B) neither common stockholders nor bondholders

C) bondholders, but after that of common stockholders

D) common stockholders, but after that of bondholders

26)

The extraordinary rise in GameStop shares in 2021 is a good example of

A) Day Trading

B) A trading Short-Squeeze

C) Hedge Funds deploying successful short trading strategies

D) Retail Investors deploying successful short trading strategies

If your noncompetitive bid for a Treasury bill is successful, then you will

A) certainly pay less than if you had submitted a competitive bid

B) certainly pay more than if you had submitted a competitive bid

C) pay the average of prices offered in other noncompetitive bids

D) pay the same as other successful noncompetitive bidders

28)

According to the Gordon growth model, what is an investor’s valuation of a stock whose current dividend is $1.00 per year if dividends are expected to grow at a constant rate of 10 percent over a long period of time and the investor’s required return is 11 percent?

A) $110

B) $100

C) $11

D) $10

29)

If, as a financial professional, you believe US interest rates are going to gradually fall over the next two weeks, which investment strategies would it make sense to engage in?

A) Sell short-maturity US Government Bonds

B) Buy US Dollars

C) Engage in a 14-day REPO and fund myself on an overnight basis

D) Engage in a 14-day REVERSE REPO and fund myself on an overnight basis

30)

Bond Issue Restrictive Covenants are related to

A) Adverse Selection

B) Moral Hazard

C) Direct Finance

D) Indirect Finance

Total 30 marks

SECTION B CONSISTS OF 10 QUESTIONS (1-10)

ANSWER 8 OUT OF THE 10 QUESTIONS

5 MARKS PER QUESTION

1.How does the Market Segmentation Theory of the yield curve explain a ‘humped’ shaped yield curve?

2.What are ‘Closet Index Funds’ and why are they a concern for regulators?

3.Why would ‘haircuts’ on collateral increase sharply during a financial crisis?

4.In January 2022, US inflation hit an annual rate of 7%. Explain the implications for short term interest rates (Fed Funds Rate), the 10-year US bond yield and the US stock markets.

5.Explain why interest rates on bank deposits can be negative. Explain whether negative interest rates on deposits always have an expansionary effect.

6.Why is there a Corporate Bond Liquidity problem today that didn’t exist before the 2008 Financial Crisis?

7.What do corporate bond ratings represent? How do they relate to corporate bond risk premium, yield and overall risk?

8.Explain why Floating Rate Note (FRN) price volatility is typically significantly less than for non-FRNs.

9.What is meant by the Eurodollar market? Why is it an important source of financing?

10.How did the structure of US Mortgage Bonds instigate the 2008 Financial Crisis?

Total 40 marks

SECTION C CONSISTS OF 9 QUESTIONS a) – i)

ANSWER ALL QUESTIONS

Based on the above chart, provide very concise answers to ALL the following questions:

What trade, in terms of buying and selling short-term and long-term securities, should a trader have put on to take advantage of the yield curve shift between 2016 and 2017? 2 marks

Suppose on 14th December 2017 the US Treasury 2-year note auction went particularly badly. What effect would this have had on the shape of the 14th December 2017 yield curve?1 mark

The US Treasury yield curve flattened between 2016 and 2017 (as shown in the diagram). What did this imply about short-term rates between 2016 and 2017 and expectations of future economic activity at that time? 2 marks

Where would ‘off-the-run’ US Treasury bonds trade in relation to ‘on-the-run’ bonds and why? 2 marks

Assuming the Fed Funds interest rate is the same as the 1-month rate, compared to 2017, are 1-month interest rates lower or higher today? 1 mark

On the 14th December 2017 the US-year Treasury was yielding 2.35%. An investor had the choice between buying this bond or a Treasury Inflation Protected Security (TIPS) with a real coupon of 1 %. If inflation turned out to be 1.5% after one year, would the investor have been better off buying the normal US Treasury 10-year or the TIPS? 1 mark

IBM issues two 20-year bonds. One is a $300 Million in issue size, one is $1 Billion. All other things being equal, which bond is likely to have a lower yield and why? 2 marks

Where would the yield premium over US Treasuries of a 5-year USD IBM bond trade relative to a 20-year USD IBM bond? Why is this? 2 marks

Often when the US Dollar strengthens Emerging Market borrowers face significant economic stress. Why is this? 2 marks

Total 15 marks

SECTION D CONSISTS OF 4 QUESTIONS a) – d)

ANSWER 3 OUT OF THE 4 QUESTIONS

FIVE MARKS FOR EACH QUESTION

For 3 out of the 4 questions below, write two paragraphs – one paragraph explaining the concept and one explaining the consequences or implications being asked.

a) Exchange Traded Funds and their popularity with investors over the last several years

b) US Non-Farm Payroll data and its significance for US financial markets.

c) The main influences on the price of oil and consideration of its price performance during the Covid-19 Financial Crisis

d) MiFID2 and its Buy/Sell side implications

Total 15 marks

更多代写:编程作业代写 ielts indicator作弊 英国宏观经济final quiz代考 化学专业essay代写 会计论文代写范文 论文润色代写

合作平台:essay代写 论文代写 写手招聘 英国留学生代写

Financial Accounting II Mid-term 财务会计考试代写 ADDITIONAL INFORMATION ADDITIONAL INFORMATION 1. The Mid-term has the duration of 90 minutes. 2. Students should have their identi...

View detailsBUSN7031: MANAGEMENT ACCOUNTING Practice Questions 管理会计代写 1. ABC has determined that the shipment setup costs should be accounted for at the batch-level of activities. ABC believes tha...

View detailsFINANCIAL ACCOUNTING II MsC in MANAGEMET / FINANCE AND ACCOUNTING FINAL EXAM 财务会计代写 INFORMATION 1.The duration of the exam is 2 hours and 30 minutes. 2.The exam must be performed ...

View details