管理会计代写 MANAGEMENT ACCOUNTING代写 会计代写

820BUSN7031: MANAGEMENT ACCOUNTING Practice Questions 管理会计代写 1. ABC has determined that the shipment setup costs should be accounted for at the batch-level of activities. ABC believes tha...

View detailsSearch the whole station

财务会计考试代写 ADDITIONAL INFORMATION

1. The Mid-term has the duration of 90 minutes.

2. Students should have their identification (ID card or passport).

3. Students can use both pen or pencil, and they can also use a scientific calculator.

4. The Mid-term is composed of 3 sections. Each section has the following marks: Section I: 6 marks; Section II: 5 marks; Section III: 9 marks.

5. The first section is composed of 8 multiple choice questions. The answers should be marked with an “X” on the answer sheet. Each question is worth 0,75 marks.

6. Students must keep the test stapled.

7. It is not allowed any type of electronic communication devices.

8. Any infraction will be penalized with the annulment of the mid-term test.

According to the Conceptual Framework of IFRS, the “materiality” is one of the ingredients of which of the fundamental qualities:

A. Relevance

B. Faithful Representation

C. Verifiability

D. None of the above

Consider the following statements: A1 – Not all intangible assets have yearly amortizations. A2 – All research and development phase expenses are recognized as expenses.

A. A1 is true and A2 is false.

B. A1 is false and A2 is true.

C. Both are true.

D. Both are false.

When a company adopts the revaluation method for valuation after acquisition of Property, Plant, and Equipment, a higher increase on fair value when compared to book value will affect positively:

A. Equity.

B. Net income.

C. Both A and B.

D. None of the above.

The cash flow received from selling a transportation equipment in a company dedicated to the delivery of merchandise is considered a cash flow from:

A. Operating activities.

B. Financing activities.

C. Investing activities.

D. None of the above.

Consider the following statements: A1 – According to IFRS, the cash flow statement can be done either by the direct or the indirect method. A2 – The sale discounts reduce the cost of an intangible asset.

A. A1 is true and A2 is false.

B. A1 is false and A2 is true.

C. Both are true.

D. Both are false.

In a pharmaceutical company, the government grant received to acquire a patent, with full reimbursement in 5 years, should be recognized according to IFRS, as:

A. Liability – grants with reimbursement

B. Equity – grants

C. Deferred Grant Revenue

D. None of the above

Consider the following information regarding the cash flows of year N:

Payment of dividends of 2.000€

Sale of an equipment 5.000€

Long-term investment in shares 2.000€

Issuance of bonds in cash of 7.000€

In the statement of cash flows at 31 of December N:

A. The net cash used by investing activities is 3.000€ and the net cash used by financing activities is 5.000€.

B. The net cash used by financing activities is 3.000€ and the net cash used by investing activities is 7.000€.

C. The net cash used by financing activities is 3.000€ and the net cash used by investing activities is -2.000€.

D. None of the above.

Company Y bought an equipment for 3.000€. In the end of year N, the accumulated depreciation is 1.800€ (after annual depreciation of N), the estimated value-in-use 1.300€, and the fair value is 1.400€. Assuming that the company Y adopted the revaluation method for valuation after acquisition, and that there are no costs to sell, the value of this equipment in the Statement of Financial Position at year end of N is (book value):

A. 1.200€.

B. 1.300€.

C. 1.400€.

D. None of the above.

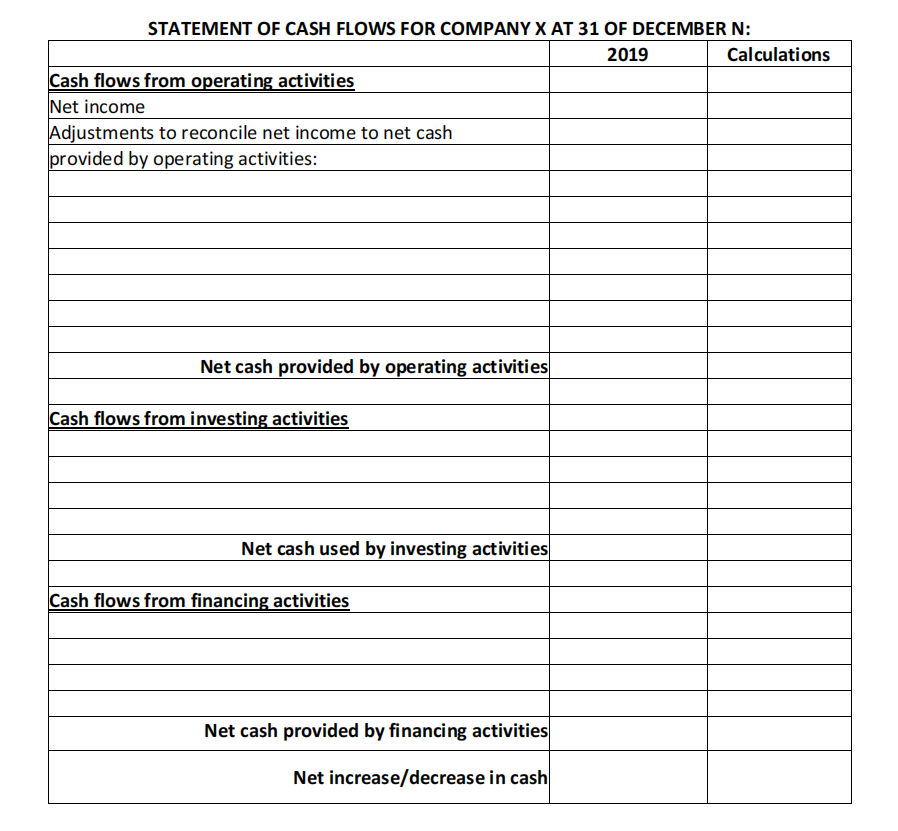

Prepare the statement of cash flows for 2019 with the following information of Company X known for the year of 2019:

1. Net income was $80,000.

2. Equipment (book value = $40,000) was sold for $30,000.

3. Treasury shares were sold at $20,000.

4. Cash dividends of $30,000 were declared and paid.

5. A long-term investment in shares was purchased for $10,000.

6. Current assets other than cash increased by $45,000.

7. Current liabilities increased by $15,000.

8. Depreciation expense was $5,000 on the building and $10,000 on equipment.

9. Payment of bank loans of $60,000.

10. Patent amortization was $5,000.

Below you can find different transactions on the same Company X in different periods of time. Please record all the necessary entries on each year per month.

a) In March N-2, Company X purchased the machine M and incurred in the following costs:

– Purchase price: 35,000€

– Installation costs: 10,000€

– Transportation costs: 5,000€

– Sales discount of 10% on purchase price.

All expenses were fully paid. It is known that the useful life of the machine is 20 years.

b) In June N-2, Company X incurred in different research and development costs to develop a patent for a new product P. On total, 30,000€ were paid. However, no economic viability has been achieved at this point in time.

Please record all necessary entries regarding year N-2:

| Date | Description | Debit | Credit | Total | Calculations |

a) In February N-1, the research team responsible for the development of the patent for the new product P concluded the tests. According to them, the patent has achieved economic viability. For the development and successful defense of the patent, Company X incurred in more costs. In total 30,000€ was paid to suppliers. It is known this patent has indefinite useful life.

b) In November N-1, Company X decided to conduct an impairment test on the following assets under the value at historical cost for valuation after acquisition:

| Machine M | Patent for product P | |

| Fair value | 46,000 € | 50,000 € |

| Fair value less costs to sell | 40,000 € | 35,000 € |

| Value-in-use | 45,000 € | 30,000 € |

Please record all necessary entries regarding year N-1:

| Date | Description | Debit | Credit | Total | Calculations |

a) In February N, Company X received a government cash grant of 100,000€ to purchase a copyright. This copyright was purchased in March N for 200,000€. However, the supplier agreed to give a trade discount of 5% on the purchase price. Company X is expected to pay the supplier in June N. The copyright is expected to have a useful life of 10 years.

b) In November N, Company X received the information that the recoverable amount of the machine M is 47,000€, and for the patent is 32,000€ (machine M and patent for product P are under the value at historical cost for valuation after acquisition)

Please record all necessary entries regarding year N:

| Date | Description | Debit | Credit | Total | Calculations |

a) In January N+1, Company X decided to apply the revaluation method for valuation of PPE after acquisition. It is known the fair value of machine M is 45,500€. The patent for product P has a fair value of 35,000€ and a recoverable value of 31,000€.

b) In November N+1, Company X decided to sell the machine M for 50,000€. The client paid in full in cash.

Please record all necessary entries regarding year N+1:

| Date | Description | Debit | Credit | Total | Calculations |

更多代写:CS网课代看 托福代考被抓 英国MICRO ECO微观经济学代写 国外研究论文写作格式代写 博士论文代写 怎么写essay论文

合作平台:essay代写 论文代写 写手招聘 英国留学生代写

BUSN7031: MANAGEMENT ACCOUNTING Practice Questions 管理会计代写 1. ABC has determined that the shipment setup costs should be accounted for at the batch-level of activities. ABC believes tha...

View detailsFINANCIAL ACCOUNTING II Mid-term Multiple-choice questions 财务会计考试助攻 1. Which of the following is a characteristic describing the primary quality of relevance? A. Materiality. B. ...

View detailsAC.F 304 ACCOUNTING AND FINANCE 会计金融市场代写 FINANCIAL MARKETS (DURATION: 2.5 HOURS plus 30 minutes upload time) This examination paper consists of four sections. All Sections (A, B, C and ...

View detailsAc.F 311 FINANCIAL ACCOUNTING II 财务会计考试代考 (DURATION: 2.5 HOURS plus 30 minutes upload time) This examination paper consists of four questions, each worth 50 marks. Answer any TWO questi...

View details