银行风险管理代写 ECOM055代写 风险管理代写 金融经济代写

470ECOM055 – Risk Management for Banking Final Exam 2021/22 Duration: 3 hours 银行风险管理代写 THIS IS AN OPEN BOOK EXAMINATION TO BE CONDUCTED ONLINE. YOU MAY REFER TO ANY OF THE COU...

View detailsSearch the whole station

国际金融和风险管理代写 SECTION A SECTION A CONSISTS OF MULTIPLE CHOICE QUESTIONS (MCQs) 1 TO 10. ANSWER ALL QUESTIONS. EACH QUESTION IS WORTH 3 MARKS.

(2.5 hours plus 30 minutes upload time)

This examination paper consists of TWO sections, A and B, worth 30 and 70 marks, respectively.

Answer ALL questions in each section.

Ensure that the start and end of each question is clearly identifiable.

The exam is open-book.

SECTION A CONSISTS OF MULTIPLE CHOICE QUESTIONS (MCQs) 1 TO 10. ANSWER ALL QUESTIONS. EACH QUESTION IS WORTH 3 MARKS. THERE IS NO PENALTY FOR AN INCORRECT ANSWER.

Identify the one true statement about the hedging with financial markets:

a. The daily trading volume of the FX market is about two times larger than the daily trading volume of the equities market.

b. Forward contracts are generally more liquid and available for trading than similar futures contracts.

c. A zero-initial-value financial instrument for hedging purposes cannot increase the firm’s value today.

d. It is possible to hedge non-linear exposure with financial instruments such asoptions.

e. None of the above.

Identify the one true statement about the money and banking system:

a. Conditions for money to be a good least-cost medium of exchange include that it must be storable, but the stable purchasing power is not required.

b. When the Fed lowers the discount rate that banks pay on short-term loans there is an increase to the liquidity of money.

c. Reserve requirement is the maximum amount of funds banks can hold againstdeposits in bank accounts.

d. Historically banks could not create more bank receipts than they had coins tocover them.

e. None of the above.

Identify the one true statement about political risk:

a. Political risk is defined as the risk of corporate defaults due to the volatility of the local currencies.

b. Most countries have an official gold parity (i.e. money can be freely converted into gold at a fixed exchange rate) to reduce political risk.

c. Political risks are highly non-linear and so can be well-hedged using options.

d. In the CAPM model there is a political risk factor which explains asset returns.

e. None of the above.

Identify the one true statement about current account:

a. To improve the current account balance one possibility is to reduce taxes.

b. Austerity measures do not improve the current account balance.

c. One way to improve the current account balance would be to increase privatesavings.

d. The current account does not include interest or dividends earned internationally.

e. None of the above.

Identify the one true statement about default risk:

a. Right of offset makes default risk of forward contracts higher and more important to hedge.

b. As the futures market is an over-the-counter market, there can be significantdefault risk, but markets have developed various ways and means to reduce the potential impact of default risks.

c. Hedging can reduce the costs of bankruptcy and financial distress.

d. Hedging of pooled cash flows can introduce default risk.

e. None of the above.

Identify the one true statement about the expected exposure of assets to a change in the GBP/EUR exchange rate:

a. Shares in a French importer from Britain have positive exposure to a change in the GBP/EUR.

b. French importer can always successfully hedge exposure to the GBP/EUR bymatching future cash inflows and cash outflows.

c. Contractual exposure of a British importer arises from a signed contract with a French exporter which ensures a known cash inflow or outflow in GBP at some specified future time.

d. British importer from France typically have much larger EUR inflows thanoutflows.

e. None of the above

Identify the one true statement about spot exchange rates:

a. As a bank customer, the bid quote is normally larger than the ask quote.

b. We define exchange rates as foreign currency (FC), against home currency (HC), that is FC/HC.

c. The liquidity of currencies in the spot market depends on maturity.

d. Market maker banks must provide a two-way (bid/ask) quote, even withoutknowing counterparty’s intention.

e. None of the above.

Identify the one true statement about the forward contract:

a. A forward contract to purchase foreign currency can be replicated by: borrowing domestic currency, converting it to foreign currency, and investing the foreigncurrency at the foreign swap rate.

b. In currency markets, companies with long positions want to sell forward, andplayers with short positions want to buy.

c. The value of a forward contract at initiation is positive reflecting its hedging benefits to the parties.

d. The potential losses of a forward currency purchase are unlimited.

e. None of the above.

Identify the one true statement about the bid-ask quotes:

a. The bid-ask spread increases with market liquidity.

b. When dealing with a bank you buy at the bid and sell at the ask.

c. The positive bid-ask spread makes arbitrage across markets easier.

d. You lend money to the bank at the ask interest rate.

e. None of the above.

Identify the one true statement about capital asset pricing:

a. International CAPM model is used to derive the riskiness of the actual cost of capital.

b. In the international CAPM, there is a political risk factor which explains asset returns.

c. International financial markets in the model are assumed to be isolated.

d. Forward exchange rates are used to calculate the foreign currency risk premium.

e. None of the above.

TOTAL 30 MARKS

SECTION B CONSISTS OF QUESTIONS a-c.

ANSWER ALL QUESTIONS

You launch a start-up in California, USA, offering remote consulting services worldwide. The first month you get contacted by three clients, one in Germany, one in New Zealand, and one in Great Britain. You would like to charge USD 1,000 to each of the three clients for an online consultation, but invoiced in their home currencies.

Your bank offers you the following bid-ask quotes: USD/EUR 1.2-1.3, USD/NZD 0.67-0.69, and USD/GBP 1.9-2.

i. If you accept these quotes what would be the amounts of the three invoices? (5 marks)

ii. Your three clients would like to negotiate discounts of EUR 300, NZD 1,000 and GBP 75, respectively. What is the value of these discounts from your perspective in USD? (5 marks) 国际金融和风险管理代写

iii. Your treasurer believes the client in Germany has greater potential for the future business than the client in Great Britain. You now would like to keep the total value of the discounts in USD the same, but renegotiate the discounts so that the client in Great Britain gets no discount for the online consultation, the client in Germany gets a larger discount, while the discount of the client in New Zealand remains unchanged. GBP/EUR is 0.5-0.7. Calculate the new discount for the client in Germany. (10 marks)

iv. Using the information on the currency rates above, calculate the bid and ask cross-rate USD/EUR. Comment on how it compares to the direct quote and explain why they differ. (5 marks)

v. Explain the difference between the concept of arbitrage and the concept of shopping around. Then argue whether your answer to the previous question suggests any opportunity for either arbitrage or shopping around (or both). (5 marks)

Your treasurer told you how at a previous employer she designed a forward contract on EUR, against USD. She purchased EUR 1m and as of today 60 days remain until expiry. The historic rate was 1.350 while the current rate for same expiry date is 1.500.

Assuming the risk-free rates are 3% (simple p.a) in USD and 4% (simple p.a) in EUR, you want to evaluate the treasurer’s decision to do so.

i. Compute the fair value of the contract. (5 marks)

ii. Explain intuitively without any calculation why the fair value is positive or negative and how it comparesto the fair value at the inception of the contract. (5 marks)

iii. Provide at least two real-life examples how this forward contract could have been used as a hedging instrument. In each example comment on whether the hedger is better off or worse off, and whether hedging was a correct decision in the first place, and what are the alternative ways to hedge when perfect cash-flow matching is not possible. (10 marks)

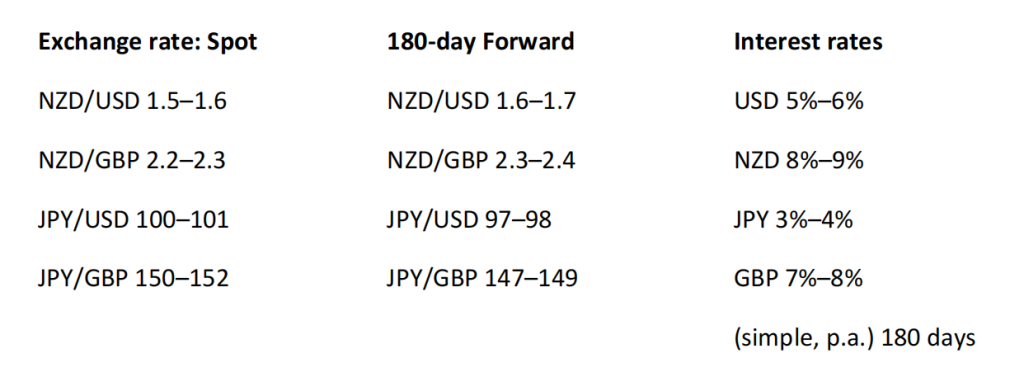

On your team, you also have a talented former trader Michael who is very experienced with the foreign exchange markets. To show her skill she shows you the Bloomberg screen with the following information:

i. Calculate the bid-ask spreads for JPY/USD and JPY/GBP spot markets and state the units clearly. Why are they positive? How does the liquidity of JPY/USD spot market compare to the liquidity of the JPY/GBP spot market? (5 marks)

ii. Calculate the synthetic 180-day forward quotes for NZD/USD, NZD/GBP, JPY/USD, and JPY/GBP. (10 marks)

iii. Given the above quotes, can Michael find any arbitrage opportunities or/and shopping around opportunities? (5 marks)

TOTAL 70 MARKS

更多代写:NetworkSocket程序代写 托福在家考试作弊 英国Psychology作业代写 Narrative Essay代写 爱尔兰课程论文代写 如何写好文献综述

合作平台:essay代写 论文代写 写手招聘 英国留学生代写

ECOM055 – Risk Management for Banking Final Exam 2021/22 Duration: 3 hours 银行风险管理代写 THIS IS AN OPEN BOOK EXAMINATION TO BE CONDUCTED ONLINE. YOU MAY REFER TO ANY OF THE COU...

View detailsIBUS 1000 Managing International Business Risk Report Assessment 1: Individual Report (20%) (1500 words +/-10%) 管理国际业务代写 Applying the Core Risk and Risk Management Concepts and Theor...

View detailsMANAGEMENT OF FINANCIAL RISK DURATION: 120 MINUTES (2 HOURS) 财务风险管理代写 This paper contains THREE questions. Answer TWO questions. If you attempt more questions than required, only the...

View detailsLUBS5006M International Business Finance Management of economic and transaction exposure (questions 1-10) 代写国际商业金融 1. DeMagistris Fashion Company DeMagistris Fashion Company, based...

View details