国际商业金融代写 International Business Finance代写

740FINS3616 – International Business Finance iLab Assignment 国际商业金融代写 Weighting This assessment is worth 15% of your final grade for FINS3616 – International Business Finance. Next ...

View detailsSearch the whole station

金融课业代写 Options on foreign exchange (questions 1-5) Interest rate and currency swaps (questions 6-10) 1. Sallie Schudel Sallie Schnudel trades

Options on foreign exchange (questions 1-5)

Interest rate and currency swaps (questions 6-10)

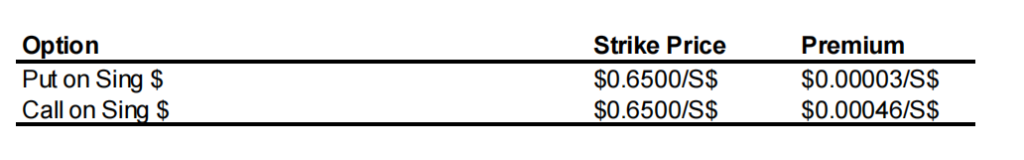

Sallie Schnudel trades currencies for Keystone Funds in Jakarta. She focuses nearly all of her time and attention on the U.S. dollar/Singapore dollar ($/S$) cross-rate. The current spot rate is $0.6000/S$. After considerable study, she has concluded that the Singapore dollar will appreciate versus the U.S. dollar in the coming 90 days, probably to about $0.7000/S$. She has the following options on the Singapore dollar to choose from:

a. Should Sallie buy a put on Singapore dollars or a call on Singapore dollars?

b. What is Sallie’s breakeven price on the option purchased in part (a)?

c. Using your answer from part (a), what is Sallie’s gross profit and net profit (including premium) if the spot rate at the end of 90 days is indeed $0.7000/S$?

d. Using your answer from part (a), what is Sallie’s gross profit and net profit (including premium) if the spot rate at the end of 90 days is $0.8000/S$?

Peleh buys a put option on Japanese yen with a strike price of $0.008000/¥ (¥125.00/$) at a premium of 0.000080$ per yen and with an expiration date six months from now. The option is for ¥12,500,000. What is Peleh’s profit or loss at maturity if the ending spot rates are ¥110/$, ¥115/$, ¥120/$, ¥125/$, ¥130/$, ¥135/$, and ¥140/$.

Assume a call option on euros is written with a strike price of $1.2500/€ at a premium of 3.80¢ per euro ($0.0380/€) and with an expiration date three months from now. The option is for €100,000. Calculate your profit or loss should you exercise before maturity at a time when the euro is traded spot at the following:

a. $1.10/€

b. $1.15/€

c. $1.20/€

d. $1.25/€

e. $1.30/€

f. $1.35/€

g. $1.40/€

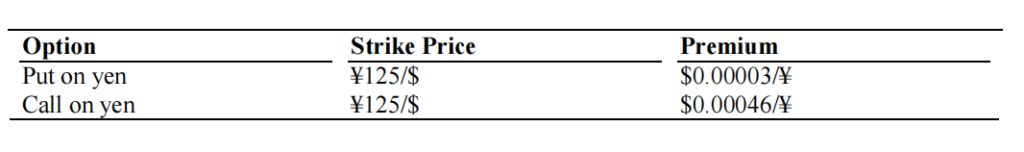

Cachita Haynes works as a currency speculator for Vatic Capital of Los Angeles. Her latest speculative position is to profit from her expectation that the U.S. dollar will rise significantly against the Japanese yen. The current spot rate is ¥120.00/$. She must choose between the following 90-day options on the Japanese yen:

a. Should Cachita buy a put on yen or a call on yen?

b. What is Cachita’s breakeven price on the option purchased in part (a)?

c. Using your answer from part (a), what is Cachita’s gross profit and net profit (including premium) if the spot rate at the end of 90 days is ¥140/$?

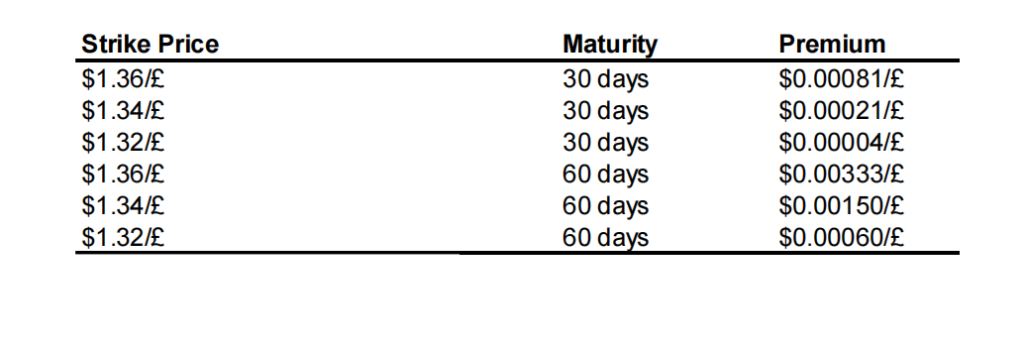

Arthur Doyle is a currency trader for Baker Street, a private investment house in London. Baker Street’s clients are a collection of wealthy private investors who, with a minimum stake of £250,000 each, wish to speculate on the movement of currencies. The investors expect annual returns in excess of 25%. Although located in London, all accounts and expectations are based in U.S. dollars.

Arthur is convinced that the British pound will slide significantly — possibly to $1.3200/£ — in the coming 30 to 60 days. The current spot rate is $1.4260/£. Arthur wishes to buy a put on pounds which will yield the 25% return expected by his investors. Which of the following put options would you recommend him to purchase? Prove your choice is the preferable combination of strike price, maturity, and up-front premium expense.

It is 12 July and the following information is available:

Sterling currency futures prices (contract size £62,500)

September $1.5552/£

December $1.5556/£

March $1.5564/£

(i) A UK company is due to receive $2m in December. Show how the company can hedge its transaction risk using sterling currency futures, assuming that the spot rate on expiry of the December sterling futures contract is $1.6502/£.

(ii) The UK company also expects to have to pay $5m to a US supplier in March next year. Show how the company can hedge its transaction risk using sterling currency futures, assuming that the spot rate on expiry of the March sterling futures contract is $1.5504/£.

Botany Bay Corporation of Australia seeks to borrow US$30,000,000 in the Eurodollar market. Funding is needed for two years. Investigation leads to three possibilities. Compare the alternatives and make a recommendation.

#1. Botany Bay could borrow the US$30,000,000 for two years at a fixed 5% rate of interest.

#2. Botany Bay could borrow the US$30,000,000 at LIBOR + 1.5%. LIBOR is currently 3.5%, and the rate would be reset every six months.

#3. Botany Bay could borrow the US$30,000,000 for one year only at 4.5%. At the end of the first year Botany Bay would have to negotiate for a new one-year loan.

B. The six-month LIBOR is given per annum.

Raid Gauloises is a rapidly growing French sporting goods and adventure racing outfitter. The company has decided to borrow €20,000,000 via a euro-euro floating rate loan for four years. Raid must decide between two competing loan offerings from two of its banks.

Banque de Paris has offered the four-year debt at euro-LIBOR + 2.00% with an up-front initiation fee of 1.8%. Banque de Sorbonne, however, has offered euro-LIBOR + 2.5%, a higher spread, but with no loan initiation fees up-front, for the same term and principal. Both banks reset the interest rate at the end of each year.

Euro-LIBOR is currently 4.00%. Raid’s economist forecasts that LIBOR will rise by 0.5 percentage points each year. Banque de Sorbonne, however, officially forecasts euro-LIBOR to begin trending upward at the rate of 0.25 percentage points per year. Raid Gauloises’s cost of capital is 11%. Which loan proposal do you recommend for Raid Gauloises?

Heather O’Reilly, the treasurer of CB Solutions, believes interest rates are going to rise, so she wants to swap her future floating rate interest payments for fixed rates. At present she is paying LIBOR + 2% per annum on $5,000,000 of debt for the next two years, with payments due semiannually. LIBOR is currently 4.00% per annum. Heather has just made an interest payment today, so the next payment is due six months from today.

Heather finds that she can swap her current floating rate payments for fixed payments of 7.00% per annum. (CB Solutions’s cost of capital is 12%, which Heather calculates to be 6% per six month period, compounded semi-annually).

a. If LIBOR rises at the rate of 50 basis points per six month period, starting tomorrow, how much does Heather save or cost her company by making this swap?

b. If LIBOR falls at the rate of 25 basis points per six month period, starting tomorrow, how much does Heather save or cost her company by making this swap?

Lluvia Manufacturing and Paraguas Products both seek funding at the lowest possible cost. Lluvia would prefer the flexibility of floating rate borrowing, while Paraguas wants the security of fixed rate borrowing. Lluvia is the more credit-worthy company. They face the following rate structure. Lluvia, with the better credit rating, has lower borrowing costs in both types of borrowing.

Lluvia wants floating rate debt, so it could borrow at LIBOR+1%. However it could borrow fixed at 8% and swap for floating rate debt. Paraguas wants fixed rate, so it could borrow fixed at 12%. However it could borrow floating at LIBOR+2% and swap for fixed rate debt. What should they do?

更多代写:CS加拿大代写网课代上 北美托福代考 英国化学网课托管 article加拿大代写价格 论文概要代写 中国论文代写

FINS3616 – International Business Finance iLab Assignment 国际商业金融代写 Weighting This assessment is worth 15% of your final grade for FINS3616 – International Business Finance. Next ...

View detailsI218 Computer ArchitectureReport 3 计算机体系结构cs代写 (1) In the textbook and lecture slides, detailed information in the pipeline registers (IF/ID, ID/EX, EX/MEM, MEM/WB) is not provided. ...

View detailsI218 Computer ArchitectureReport 2 cs计算机体系结构作业代做 (1)How is the instruction “sub $t9, $s4, $s7” translated to a machine instruction code? Answer the rs, rt, and rd fields in binary n...

View detailsEconomics 426: Problem Set 1 – Robinson Crusoe 经济问题集代做 I. Robin Crusoe is endowed with 112 labor-hours per week. There is a production function for the output of oysters Spring...

View details