代写代考安全吗?被发现了会被抓起来吗?

824代写代考安全吗?被发现了会被抓起来吗? 代写代考 留学生在国外的学习过程的压力都是非常的大的,很多留学生都害怕自己最后毕不了业,让自己的时间白白的浪费,还浪费了家里的资金,非常的郁闷,为了能够顺...

View detailsSearch the whole station

国际商业金融代写 Weighting This assessment is worth 15% of your final grade for FINS3616 – International Business Finance. Next to each question is the

This assessment is worth 15% of your final grade for FINS3616 – International Business Finance. Next to each question is the allocation of marks. There are a total of 30 marks for this assignment.

The purpose behind this assignment is to get students to:

1. apply and assess the relevance of the International Parity Conditions and Purchasing Power Parity (PPP) Theory in a practical setting,

2. think outside the textbook and homework questions framework,

3. conduct their own research,

4. use actual data and statistical methods (regression and regression analysis),

5. improve their familiarity with statistical tools in Microsoft Excel.

This assignment is designed to give students an insight into how economists and analysts in industry approach the topic of exchange rate modelling. 国际商业金融代写

This assignment is individual work and must be submitted as individual work only.

The lecturer in charge will randomly assign each student one of four countries in the list below:

1. England (GBP)

2. Germany (EUR)

3. Japan (JPY)

4. Switzerland (CHF)

Once assigned a country, the student will analyse the exchange rate comprising that country’s currency in relation to that of the United States. Thus, for example, if a student is assigned Switzerland, then they are required to complete the iLab assignment on the CHF/USD exchange rate.

You are constructing a regression model to forecast an estimate of the exchange rate. You expect changes in future exchange rates depend on a set of key macroeconomic variables:

1. the countries’ real GDP growth rates

2. the inflation rate differential

3. long-term interest rate differential

1.1 – Using FactSet, obtain quarterly data from 2001Q1 to 2021Q3 on:

– The exchange rate you have been randomly assigned.

– Economic growth rates for both countries, defined as the year-on-year % change in real GDP.

– Inflation rates for both countries, defined as the year-on-year % change in the Consumer Price Index (CPI).

– Long-term interest rates for both countries.

1.2 – Using the data you collected from FactSet, calculate the following:

– The change in exchange rates over (i) 1 quarter, (ii) 1 year, and (iii) 3 years.

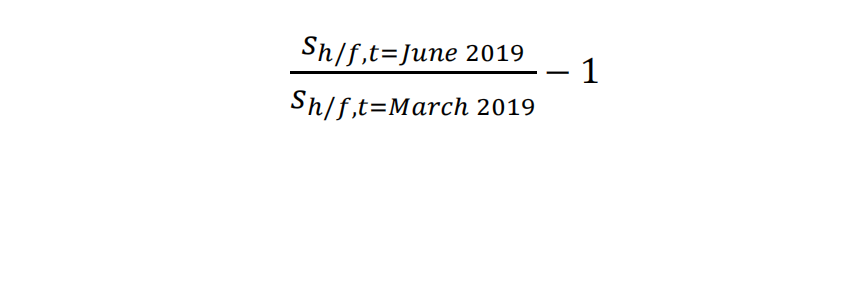

These must be forward looking. Calculating a forward-looking change in the exchange rate is best illustrated by an example. Thus, for example, the one-quarter change in the spot exchange rate, , for March 2019 is:

– Economic growth rates for both countries as a decimal. This is done by dividing the FactSet value by 100.

– The inflation rate differential as a decimal (ensure that you divide the FactSet value by 100), which for simplicity, we define as the rate for the country you have been assigned less the US rate.

– The long-term interest rate differential as a decimal (ensure that you divide the FactSet value by 100), which for simplicity, we define as the rate for the country you have been assigned less the US rate.

Answer the following questions once you have collected all the necessary data – as per Section 1.

2.1 – Use the realised rates of inflation for both countries from the start of the sample period to the end of the sample period to calculate the RPPP-implied exchange rate. In other words, suppose we are in the year and quarter corresponding to the start of the sample period, and we want to forecast the exchange rate one year ahead. Repeat for each quarter in the sample period.

You can refer to Exhibit 4-7 in the textbook (page 151) to give you a sense of what is being expected. How well does RPPP explain the exchange rate? You will need to compare the RPPP-implied exchange rate with the realised exchange rate. Plot the two time series in a graph. The word limit in this question is 150 words. (2 marks)

2.2 – Calculate the value of the real exchange rate at the end of the sample period, and compare it with the value of the real exchange rate at the start of the sample period. Provide brief commentary about the reasons for the change or lack thereof in the real exchange rate in no more than 150 words. You should focus on the effect of inflation rates, real interest rates, and which agents in the two economies benefitted from the changes in the real exchange rate (for example, were importers or exporters the main beneficiaries?) (2 marks)

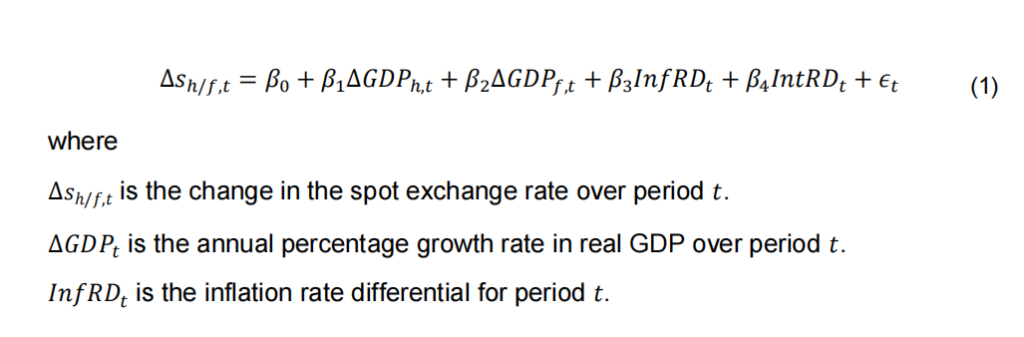

3.1 – Consider the following econometric structural model of the change in the exchange rate:

IntRDt is the interest rate differential for period t .

Using linear regression, obtain the coefficient estimates for each of the 3 time horizons. You should report the ALL coefficient estimates in one table, so the grader is able to see your results in your written submission (rather than having to refer to the Excel file). (3 marks)

3.2 – Analyse the statistical significance of the coefficient estimates at the 5% level. You are to provide a summary/high-level analysis of the key results. Word limit: 100 words. (3 marks)

3.3 – Consider both the p-value associated with the F-statistic (at the 5% level of significance) and the adjusted R-squared as the forecast horizon increases from 1 quarter to 3 years. Provide some commentary and discuss whether such results (across the 3 models) are consistent with PPP theory. Word limit: 150 words. (2 marks)

3.4 – Which macroeconomic variable(s) are considered economically important for modelling changes in the exchange rate? Are you surprised by these results? Are they consistent with PPP Theory? Word limit: 100 words. (2 marks)

– One potential issue the analyst faces when using multiple linear regression analysis is the collinearity of the independent variables. Verify whether or not multicollinearity exists among the independent variables. Word limit: 100 words. (2 marks)

3.6 – Residual Analysis – Are the residuals from each regression model normally distributed with a mean of 0? If so, then this suggests that there is no information left in the residuals that could otherwise have been used to explain the change in the exchange rate. You must conduct this analysis for the 1-quarter, 1-year and 3-year regression models. Provide a written summary of whether the residuals from each regression model normally distributed with a mean of 0. (3 marks)

3.7 – Residual Analysis – Report whether or not the residuals are independent from one another. Independence can be verified by plotting the residuals in the order or sequence in which the observed data were collected. If there is a pattern among the residuals, then you can infer that the residuals are dependent on one another. You must conduct this analysis for the 1-quarter, 1-year and 3-year regression models. (3 marks)

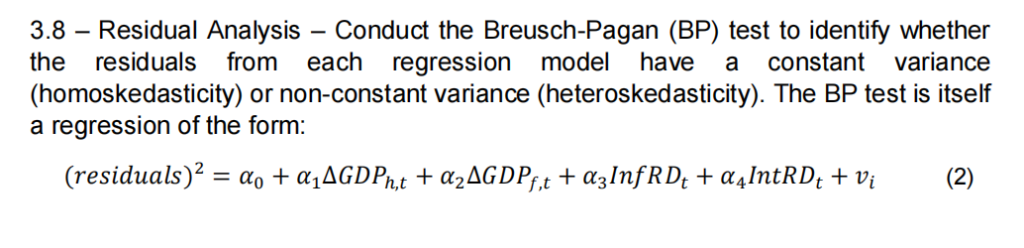

Once you have estimated this regression model, look at the p-value associated with the F-statistic. If that p-value is less than 5% then you reject the null hypothesis (of homoskedasticity) in favour of the alternative. Rejecting the null suggests that the model suffers from heteroskedasticity. You must conduct this analysis for the 1- quarter, 1-year and 3-year regression models. (3 marks)

4.1 – Using the latest values of the key macroeconomic variables forecast the estimated change in the exchange rate:

a) 1-quarter ahead,

b) 1-year ahead

c) 3-years’ ahead

Report the magnitude of the forecasts for each regression model. (1 mark)

4.2 – Do you think that the structural model (Equation 1) is a useful model? What are some of its limitations? Irrespective of your answer, what other independent variable would you include in Equation 1? Provide at least one economic reason for that variable’s inclusion. You should also provide commentary indicating what relationship this variable has with the change in the exchange rate (that is, the dependent variable). Word limit: 150 words. (2 marks)

1. Two marks out of the 30 marks will be allocated to grammar, spelling, professionality of the responses and ensuring that all data and calculations in the Excel file are expressed to 3 decimal places. You need to ensure that your work is polished and contains NO errors. Remember you are presenting your work. When you are working professionally, the market expects high quality output.

2. If you use sources in your answers, ensure that you formally cite them. The style of referencing is for you to decide.

3.Plagiarism is not tolerated. Your answers must be written by you and only you. Turnitin has a similarity indicator that reports a percentage similarity score. Submissions with similarity scores should not be greater than 15% if they are written in your own words.

Turnitin includes the cover sheet and your references list in its calculation of its similarity score. However, the grader will be able to filter this out and see the percentage similarity score based only on the student’s written responses.

1. Students will only be permitted to submit their iLab assignment ONCE in Turnitin.

2. There is NO grace period for any submissions.

3. Lengthy responses to questions will result in only the first 150 words of each part being graded.

4. If a student submits their iLab assignment on an exchange rate other than the exchange rate they were assigned, then the maximum grade that can be awarded is 60%.

5. If a student submits their iLab assignment via the incorrect Turnitin submission link, then 1 mark will be deducted.

6. You must type your answers and submit as a PDF document via Turnitin. Ensure that the cover sheet is attached with your submission. See Moodle for cover sheet. A submission without the cover sheet will result in 1 mark being deducted.

7. Submit your Excel file with the calculations. Failure to submit the Excel file will result in a deduction of 1 mark.

8. The School of Banking and Finance’s policy stipulates that late submissions will attract a 5% penalty per day following the assignment due date (weekend days included). A submission made one week (that is, 7 days) after the specified due date will result in a grade of 0.

The Lecturer-in-charge may modify this list in light of changing circumstances. Any changes made will be communicated to students as an announcement via the Moodle webpage.

更多代写:CS加拿大exam代考 duolingo代考 英国环境艺术类代考 加拿大包写作网课 会计学论文作业代写 毕业设计代做

合作平台:essay代写 论文代写 写手招聘 英国留学生代写

代写代考安全吗?被发现了会被抓起来吗? 代写代考 留学生在国外的学习过程的压力都是非常的大的,很多留学生都害怕自己最后毕不了业,让自己的时间白白的浪费,还浪费了家里的资金,非常的郁闷,为了能够顺...

View detailsLUBS5006M International Business Finance SEMINAR FOUR 金融课业代写 Options on foreign exchange (questions 1-5) Interest rate and currency swaps (questions 6-10) 1. Sallie Schudel Sallie ...

View detailsIEOR 4700 Homework 10: Wednesday April 7 2021 金融工程作业代写 Problem 2. [25 points] Assume the continuously compounded spot rates of Problem 1. Find the value of an FRA that enables the h...

View detailsFNCE 435 – Empirical Finance Individual Assignment (Section I) 实证金融作业代写 (Important: This assignment is to be implemented on an individual basis. No sharing of material— including da...

View details