数理经济学代写 EC301代写 经济学考试代考 经济学代写

876EC301 Test 数理经济学代写 You have 90 minutes plus 15 minutes reading time. During the reading time, you may write on the question paper but not inside your answer booklet. You have 90 min...

View detailsSearch the whole station

应用财富管理代写 Duration: 60 minutes (both answering, solving and uploading) Answer ALL questions THIS IS AN OPEN BOOK EXAMINATION TO BE CONDUCTED ONLINE.

Duration: 60 minutes (both answering, solving and uploading)

Answer ALL questions

THIS IS AN OPEN BOOK EXAMINATION TO BE CONDUCTED ONLINE. YOU MAY REFER TO ANY OF THE COURSE MATERIALS, OR ANY OTHER SOURCE OF INFORMATION. YOU MAY ALSO USE A SPREADSHEET OR CALCULATOR.

YOU CANNOT SUBMIT HANDWRITTEN ANSWERS

PLEASE ENSURE THAT YOUR WORKING IS CLEARLY SHOWN WITH ALL STEPS OF YOUR CALCULATION INCLUDED IN YOUR ANSWER DOCUMENT, INCLUDING ANY FORMULA USED.

• It is acceptable to use the standard alphabet rather than greek letters. The following are recommended: m for μ, s for σ, w for ω, r for ρ, d for Δ, b for β.

• For mathematical operators: add +, subtract -, multiply *, and divide /.

• Where appropriate, use an underscore to indicate a subscript, Eg r_f for rf.

• Use the ^ character for power, eg x^2 for x2, x^0.5 for √x.

• As an alternative to x^.5 you may type sqrt(x).

• Use brackets as necessary. To make your answer clearer use different brackets where appropriate, eg [] {} ().

For the 4 Multiple Choice Questions Tick √ the correct answer in the table below.

If you believe the options available are not correct, please, provide your own within the table. (20 marks)

| a) | b) | c) | d) | e) | |

| 1 | |||||

| 2 | |||||

| 3 | |||||

| 4 |

AZ expects taxable ordinary income (excluding investments) of £200,000 this tax year. She currently has £275,000 in a taxable investment account for which his main objective is retirement in 15 years.

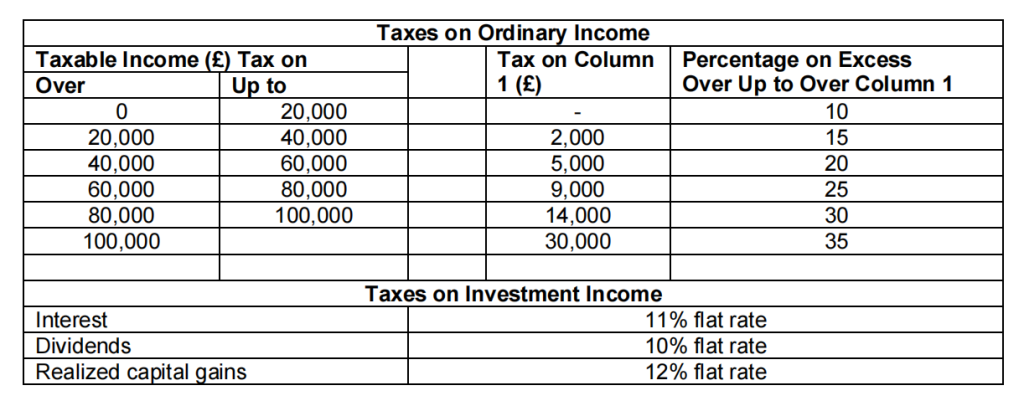

The income tax structure of her country is:

Multiple Choice Question 1.

What is AZ’s average tax rate on ordinary income?

A. 22.5%.

B. 31.5%.

C. 35.0%.

D. 30.0%

E. 32.5%

Multiple Choice Question 2.

If AZ’s current investment account of £275,000 is invested in an asset which is expected to earn annual interest of 7.5 percent and no capital gains, what is her expected after tax accumulation in 16 years?

A. £778,664.

B. £786,547.

C. £742,960.

D. £773,277.

E. £782,960.

Multiple Choice Question 3. 应用财富管理代写

What is the accrual equivalent return assuming the facts in Question 2?

A. 6.875%.

B. 6.775%.

C. 6.675%.

D. 6.555%.

E. 6.950%.

Multiple Choice Question 4.

If AZ’s current investment account of £275,000 is invested in an investment which is expected to earn a return of 7.5 percent, all of which are deferred capital gains, what is her expected after-tax accumulation in 15 years? The account’s market value is equal to its cost basis.

A. £740,747.

B. £749,048.

C. £790,747.

B. £765,747.

E. £790,747

YM is determining the impact of taxes on his expected investment returns and wealth accumulations. YM lives in a ta jurisdiction with a flat tax rate of 21 percent which applies to all types of income and is taxed annually. YM expects to earn 8 percent per year on his investment over a 21-year time horizon and has an initial portfolio of €102,000.

a) What is YM’s expected wealth at the end of 20 years? (8 marks)

b) What proportion of potential investment gains were consumed by taxes? (8 marks)

Now assume that the return of YM’s investment of €102,000 at 8 percent comes in the form of deferred capital gains that are not taxed until the investment is sold in 21 years hence.

c) What is YM’s expected wealth at the end of 21 years? (8 marks)

d) What is the accrual equivalent return? (8 marks)

e) What is the accrual equivalent tax rate? (8 marks)

Discuss how taxes affect investment risk. (40 marks)

更多代写:C++ Assignemnt代写 托福在家考机经 英国法律学网课代修代上 essay写手招聘 cover letter怎么写 如何快速写论文

合作平台:essay代写 论文代写 写手招聘 英国留学生代写

EC301 Test 数理经济学代写 You have 90 minutes plus 15 minutes reading time. During the reading time, you may write on the question paper but not inside your answer booklet. You have 90 min...

View detailsMGT 203: Managerial Economics 管理经济学代考 1.What are the three primary measures used in macroeconomics to assess the performance of an economy? Briefly explain each measure. 1. What ...

View detailsECON5007 经济练习题代写 Week 9 review questions 1.What is the role of an arbitrageur in the context of futures markets? 2.How does a futures contract differ in relation to Week 9 review ques...

View detailsECON 3H03 – INTERNATIONAL MONETARY ECONOMICS MIDTERM EXAM 2 国际货币经济学代写 This midterm is individual and closed-book. For the multiple choice questions, choose the option that best answ...

View details