国际货币经济学代写 ECONOMICS代写 EXAM代写 经济学代写

1013ECON 3H03 – INTERNATIONAL MONETARY ECONOMICS MIDTERM EXAM 2 国际货币经济学代写 This midterm is individual and closed-book. For the multiple choice questions, choose the option that best answ...

View detailsSearch the whole station

经济练习题代写 Week 9 review questions 1.What is the role of an arbitrageur in the context of futures markets? 2.How does a futures contract differ in relation to

1.What is the role of an arbitrageur in the context of futures markets?

2.How does a futures contract differ in relation to a forward contract?

3.Explain how Exchange for physicals (EFP) can be used to terminate a futures position.

4.What is the difference between ‘initial’ margin and ‘maintenance’ margin?

5.What investment objective might an investor seek to achieve through the implementation of a ‘straddle’ trade?

6.Explain how an arbitrage opportunity arises if F(t,T) < R(t,T).p(t)

7.Explain why the following relationship may be consistent with an absence of arbitrage opportunities: F(t,T)<= [R(t,T) + c(t,T) – y(t,T)].p(t)

8.How can a forward contract be revalued? Provide an example.

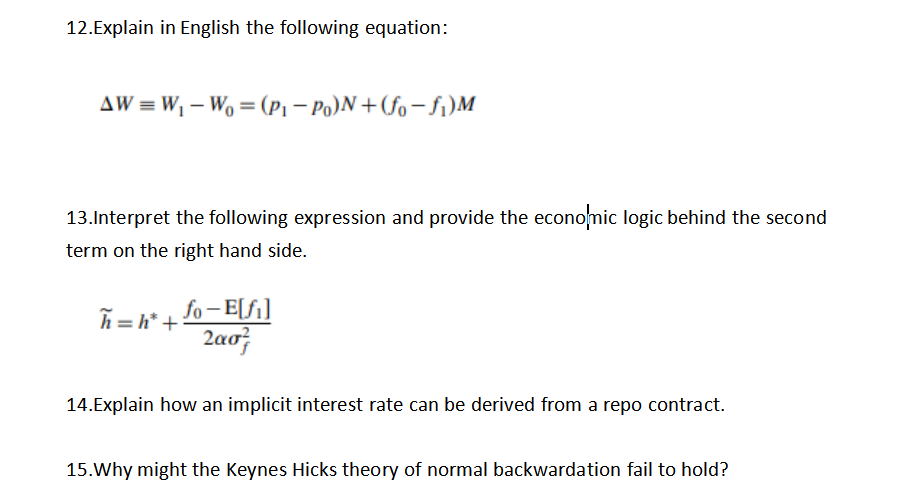

9.Explain the concept of covered interest parity and demonstrate the relationship with an example using a specific spot rate and interest rates to derive the forward rate.

10.What is meant by a ‘perfect’ hedging strategy?

11.Provide at least two reasons why a perfect hedge may be difficult to implement.

1.What is the difference between a ‘covered’ versus a ‘naked’ option position?

2.Draw a net payoff diagram for a long call option.

3.On the diagram you drew in Q2, assume the following information: X=5, S=10, c=2. Show the respective information including the payoff on the diagram.

4.Draw a net payoff diagram for a short put option.

5.On the diagram you drew in Q4, assume the following information: X=10, S=7, p=1. Show the respective information on the diagram including the payoff.

6.Can an option with zero intrinsic value have a positive price? Explain.

7.What are the major differences between an equity warrant and an option contract?

8.Outline the steps in deriving/proving the ‘bounds’ on option prices relative to their underlying asset prices.

9.Why is a call option never worth more than the value of its underlying asset?

10.Define the put call parity relationship and prove an arbitrage opportunity exists if the equality of the relationship is violated.

11.Explain the payoff in different states of the world to bond holders under the Modigliani-Miller theorem.

12.Explain the obligation on the writer of a put option over a futures contract upon exercise.

13.Check the calculation of the net effective interest rate in the table provided on p502 of Bailey when the market rate of interest is 7%.

更多代写:算法实现代写 托福在家考试作弊 英国数学代写ASSIGNMENT 斯旺西大学论文代写 说明文Essay代写 美国代写论文

合作平台:essay代写 论文代写 写手招聘 英国留学生代写

ECON 3H03 – INTERNATIONAL MONETARY ECONOMICS MIDTERM EXAM 2 国际货币经济学代写 This midterm is individual and closed-book. For the multiple choice questions, choose the option that best answ...

View detailsECON 701 MODULE 9 EXERCISES 博弈论作业代写 Exercise 1. Draw the following two trees and give the function p by specifying what p(x) is for each x in X for both trees. Exercise 1. Draw ...

View detailsEconomics 426: Problem Set 6 – Convexity and Separation 代写经济学问题集 I. Suppose F(x, y) := x1/2 y1/2 and g(x, y) = x2 + y2 . A. Draw A := {(x, y)|g(x, y) ≤ 1} and B := {(x, y)|F(x, y)...

View detailsEconomics 426: Problem Set 5 经济学问题集代写 I. Let {xn} be a sequence in Rn . Show that if xn is convergent, then the sequence must be bounded. II. Let A := (0, 1) × {0} be a subset of R2. ...

View details