微观经济学代写 MICROECONOMICS代写 exam代写

935MICROECONOMICS 微观经济学代写 1. According to the theory of firm, which of the following statements is not correct? a. AC = unit cost considering all produced units READ CAREFULY AND FOLLOW ...

View detailsSearch the whole station

国际货币经济学代写 This midterm is individual and closed-book. For the multiple choice questions, choose the option that best answers/completes the question/

Instructions: You have 50 minutes to work on the exam (from 11:30 am to 12:20 pm).

This midterm is individual and closed-book. For the multiple choice questions, choose the option that best answers/completes the question/enunciate, and clearly mark your answer.

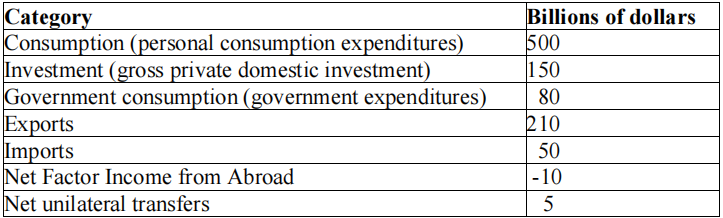

Table: Hypothetical Canadian National Income and Product Accounts Data

1. (Table: Hypothetical Canadian National Income and Product Accounts Data) The GNI for the economy provided is ______.

A) $730

B) $780

C) $890

D) $880

2. (Table: Hypothetical Canadian National Income and Product Accounts Data) Canada’s savings are equal to:

A) $150

B) $ 305

C) $ 300

D) $ 155

3. It is better to invest in a country whose shocks:

A) are positively correlated with yours.

B) are negatively correlated with yours.

C) are independent of yours.

D) are common to yours.

Assume the consumption function is C=0.3 + 0.6(Y-T). The trade balance is TB = 0.25(1-[1/E]) – 0.1(Y-8).

4. What is the marginal propensity to save?

A) 0.1

B) 0.6

C) 0.5

D) 0.4

5. What is the marginal propensity to consume home goods?

A) 0.1

B) 0.6

C) 0.5

D) 0.4

6. Suppose an economy with a floating exchange rate is in a liquidity trap at the zero-lower bound.

A) Expansionary monetary policy is more effective to increase output

B) Contractionary fiscal policy is more effective to increase output

C) Expansionary fiscal policy is more effective to increase output

D) Contractionary monetary policy is more effective to increase output

SCENARIO: IS-LM-FX

Assume that initially the IS curve is given by

IS1: Y = 24 – 3T – 60i + 4G,

Assume as well that the price level P is 1, and the LM curve is given by

LM1: M = Y(2- i).

And that the forex market equilibrium is characterized by:

i = ([Ee / E]-1) + 0.20

Finally, assume that T=3, G=3, and the home interest rate is 0.3 (i.e. 30%).

7. (Scenario: IS-LM-FX) What is the level of output according to the IS1 curve?

A) 5.5

B) 6

C) 9

D) 103

8. (Scenario: IS-LM-FX) If the level of output is the one determined by the IS1 curve, what is the equilibrium level of home money supply?

A) 15.3

B) 1.8

C) 5.2

D) 9

9. (Scenario: IS-LM-FX) If the expected exchange rate is equal to 1, how much should the current value of the spot exchange rate be?

A) 1.0

B) 1.1

C) 0.71

D) 0.91

SCENARIO: EXCHANGE RATE CHANGE: Suppose that Canada decides to peg its dollar ($C, or the loonie) to the U.S. dollar at an exchange rate of $C1 = $US1.

10. (Scenario: Exchange Rate Change) Will there be pressure for the Canadian dollar to change in value against the U.S. dollar because of a rightward shift of the U.S. IS curve?

A) Yes, there will be pressure for the Canadian dollar to appreciate.

B) Yes, there will be pressure for the Canadian dollar to depreciate.

C) No, there will be no pressure for Canadian dollar to change in value.

D) Not enough information.

11. (Scenario: Exchange Rate Change) What must the Bank of Canada do (after observing a rightward shift in the U.S. IS curve) to maintain Canada’s peg of $C1 = $US1 against the U.S. dollar?

A) It must use an expansionary monetary policy.

B) It must use a contractionary monetary policy.

C) It does not need to change its monetary policy.

D) None of the above.

12. Assume Britain maintains a fixed exchange rate with Germany. Suppose that Germany increases its interest rates. Assuming Britain maintains its fixed exchange rate (using monetary policy), the likely impact on the British economy would be:

A) a boom

B) a recession

C) an appreciation of the pound

D) a depreciation of the pound

In this question assume all dollar units are real dollars in billions, so $300 means $300 billion. It is year 0. Argentina thinks it can find $300 of domestic investment projects with an MPK of 40% (each $1 invested pays off $0.40 in every later year). Argentina invests $192 in year 0 by borrowing from the rest of the world at a world real interest rate r* of 20%. There is no further borrowing or investment after this.

Use the standard assumptions: Assume initial external wealth W (W in year -1) is 0. Assume G=0 always; and assume I=0 except in year 0. Assume NUT= KA = 0 and that there is no net labor income so that NFIA = r*W.

The projects start to pay off in year 1 and continue to pay off all years thereafter. Interest is paid in perpetuity, in year 1 and every year thereafter. In addition, assume that if the projects are not done, then GDP=Q=C= $600 in all years, so that: PV(Q) = PV(C) = 600 + 600/0.20 = 3,600.

b) From this point forward, assume the projects totaling $192 are funded and

completed in year 0. If the MPK is 40%, what is the total payoff from the

projects in future years?

c) Assume this is added to the $600 of GDP in all years starting in year 1. In dollars, what is Argentina’s Q = GDP in year 0, year 1, and later years?

d) At year 0, what is the new PV(Q) in dollars? Hint: To simplify, calculate the

value of the increment in PV(Q) due to the extra output in later years.

e) At year 0, what is the new PV(I) in dollars? Therefore, what does the LRBC say is the new PV(C) in dollars?

f) Assume that Argentina is smoothing consumption. What is the percent change in PV(C)? What is the new level of C in all years? Is Argentina better off?

g) For the year the investment projects go ahead, year 0, explain Argentina’s

balance of payments as follows: State the levels of CA, TB, NFIA, and FA.

i) What happens in later years? State the levels of CA, TB, NFIA, and FA in year 1 and every later year.

更多代写:python代写 GMAT代考 英国代修夏季网课 法律学essay代写 多伦多英语论文代写 留学生作业代写

合作平台:essay代写 论文代写 写手招聘 英国留学生代写

MICROECONOMICS 微观经济学代写 1. According to the theory of firm, which of the following statements is not correct? a. AC = unit cost considering all produced units READ CAREFULY AND FOLLOW ...

View detailsECON3006/4437/8037: Financial Economics Assignment 2, Week 7-9 金融经济学作业代写 General Information: • 100 % = 27 points. • Maximal 3 students can submit one solution of Assignment 2. All...

View detailsSTAD57 Time Series Analysis Final Examination 时间序列分析代写 Duration: 3hours Examination aids allowed: Non-programmable scientific calculator, open book/notes Instructions: • Read the...

View detailsEC301 Test 数理经济学代写 You have 90 minutes plus 15 minutes reading time. During the reading time, you may write on the question paper but not inside your answer booklet. You have 90 min...

View details