金融数学代考 MT4551代写 Financial Mathematics代写

MT4551 Financial Mathematics

金融数学代考 1. (a) The following three risk-free bonds are available, (i) Costs 82p now and pays out 87p in 6 months. (ii) Costs 87p now and pays an interest of

EXAM DURATION: 2 hours

EXAM INSTRUCTIONS: Attempt ALL questions.

The number in square brackets shows the maximum marks obtainable for that question or part-question.

Your answers should contain the full working required to justify your solutions.

INSTRUCTIONS FOR ONLINE EXAMS:

Each page of your solution must have the page number, module code, and your student ID number at the top of the page. You must make sure all pages of your solutions are clearly legible.

1. 金融数学代考

(a) The following three risk-free bonds are available,

(i) Costs 82p now and pays out 87p in 6 months.

(ii) Costs 87p now and pays an interest of 1.5p in 6 months and a final payment of 98p in 12 months.

(iii) Costs Xp now and pays 2p in 6 months and 102p in 12 months.

Using discrete interest, determine the 6 and 12 month interest rates (expressed in terms of annual values) and calculate the price X of bond (iii). [4]

(b) Consider a trading strategy consisting of the following options,

(i) Long Put, Strike E1 = £20 and cost P1 = £0.5.

(ii) Long Call, Strike E2 = £30 and cost C2 = £1.0.

Draw the profit/loss diagram for this trading strategy and determine under what conditions a profit is made ? [3]

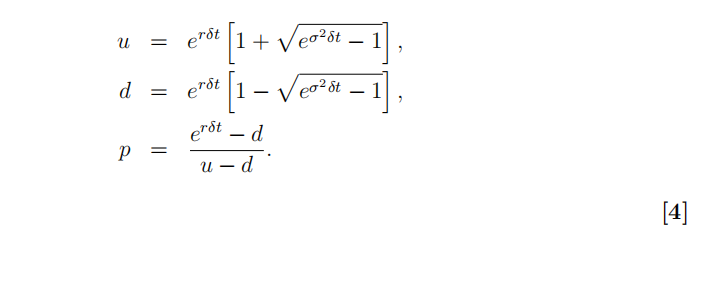

(c) Consider the binomial tree method of pricing an option. In each step, the share price (S) may either increase by a multiple u (> 1) or decrease by d (< 1). Assuming that p is the probability of an up move, construct a binomial tree with δt = 1 month to calculate the price of a 3 month European Put option if S(t = 0) = £40, E = £64, r = 2% and σ = 25%. For the calculation you may assume

3. 金融数学代考

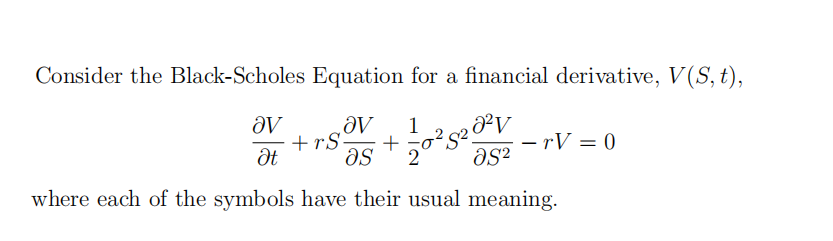

(a) For the case where V = V (S), so that the financial derivative is independent of time, the Black-Scholes Equation reduces to an ordinary differential equation (ODE). Solve this ODE to obtain its two possible solutions. [4]

(b) (i) A financial derivative pays out an amount bSn at time T, where S is the value of a share, b a constant and n a positive integer. Assuming that,

V (S, t) = A(t)Sn

is a solution of the Black-Scholes equation, determine the ordinary differential equation that A(t) satisfies. [3]

(ii) State the boundary condition that A(t) must satisfy to produce the stated pay out of the financial derivative at t = T. [1]

(iii) Solve the ordinary differential equation for A(t), to find an expression for the value of the financial derivative V at time t before expiry, T. [4]

更多代写:C#作业被判抄袭 北美托福代考 英国bibliography是啥 essay论文润色修改 论文引用怎么标注 代考数学考试

合作平台:essay代写 论文代写 写手招聘 英国留学生代写

作业代写

作业代写