管理会计代写 MANAGEMENT ACCOUNTING代写 会计代写

1117BUSN7031: MANAGEMENT ACCOUNTING Practice Questions 管理会计代写 1. ABC has determined that the shipment setup costs should be accounted for at the batch-level of activities. ABC believes tha...

View detailsSearch the whole station

管理会计考试代考 Part I (Based on this part, answer questions 1 to 6, inclusive) Company FAZFAZ produces and sells two different products, which are obtained

(Based on this part, answer questions 1 to 6, inclusive)

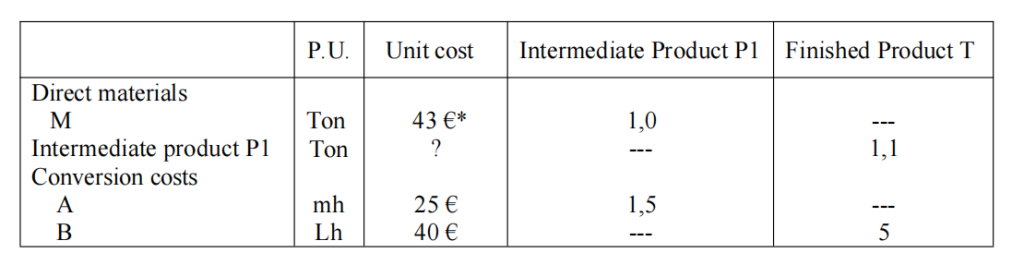

Company FAZFAZ produces and sells two different products, which are obtained according to the following production process:

Regarding the annual budget for year N, prepared according to the absorption costing system, on a semi-annual base, the following elements are known:

| P.U. | Selling price | Receipt term (days) | 1st Semester | 2nd Semester | |

| Finished Product P | Ton. | 100 € | 30 | 7.500 | 7.500 |

| Finished Product T | Ton. | 350 € | 30 | 60.000 | 72.000 |

The sales are forecasted to be regular throughout each semester.

* includes the WDM unit allocation base

Note: the beginning inventories of direct material M is valued, in the opening balance sheet, at the same unit purchase cost forecasted for year N.

– Holiday subsidy, paid in July, corresponding to 1 month of salary;

– Christmas subsidy, paid in December, corresponding to 1 month of salary;

– Contributions to Social Security: 23,75% on salaries and subsidies, having a payment term of 30 days;

– Other social charges with employees: 37.500€.

The company withholds from the employee’s salary the following amounts: social security contributions at 11% and income tax at 14%.

o First semester: positive cash balance of 500.000€;

o Second semester: positive cash balance of 250.000€;

(Based on this part, answer questions 7 to 13, inclusive)

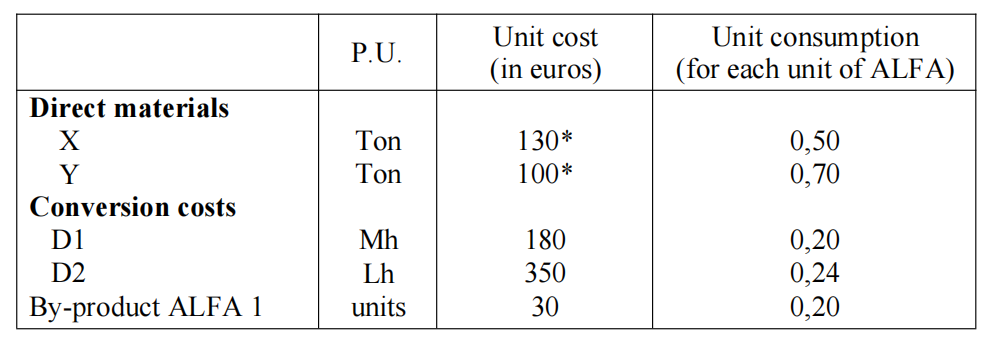

ROME company is dedicated to the production and sales of product ALFA and by-product ALFA1.

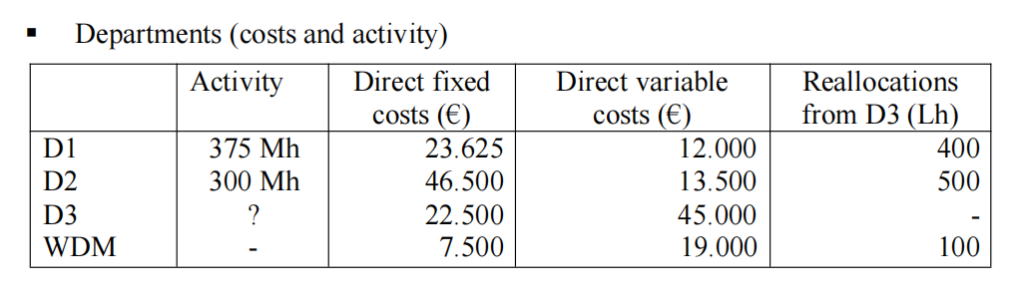

ROME uses the departmental method and charges costs using the absorption costing system and the following departments have been identified:

Department 1 (D1) allocation base: Mh

Department 2 (D2) allocation base: Mh

Department 3 (D3) allocation base: Lh

There is also a Warehouse of Direct Materials (WDM), whose costs are allocated to the purchased quantities of materials X and Y.

| Product ALFA | By-product ALFA1 | Production |

| Production | 15.000 units | 600 units |

| Sales | 10.000 units | 600 units |

| Selling price | 500 €/unit | 30 €/unit |

The forecasted sales of product ALFA, for the second semester, correspond to 66% of the annual sales. The sales of by-product ALFA1 are forecasted to be regular throughout the year.

The commercial variable costs of ALFA correspond to 5% of the sales value.

* includes the WDM unit allocation base5

| Description | D1: 3.200 Mh | D2: 3.600 Mh |

| 1. Direct costs | ||

| Variable | 96.000 | 180.000 |

| Fixed | 360.000 | 954.000 |

| subtotal | 454.500 | 1.134.000 |

| 2. Reallocations | ||

| D3 | 120.000 | 126.000 |

| 3. Total cost | 576.000 | 1.260.000 |

| Purchases | Purchase price | Consumption | |

| Material X | 1.000 ton | 115 €/ton | 750 ton |

| Material Y | 1.000 ton | 85 €/ton | 1.000 ton |

| Product ALFA | By-product ALFA 1 | |

| Production | 1.500 units | 275 units |

| Sales | 1.200 units | 70 units |

| Selling price | 400 € / unit | 32 € / unit |

The commercial variable costs of ALFA corresponded to 5% of the sales value.

Regarding the year N, the following information is known regarding GB and FC:

| GB | FCB | |

| Economic Assets at 31/12/N-1 | 1.500.000€ | 2.500.000€ |

| Sales | 5.000.000€ | 15.000.000€ |

| NOP | 150.000€ | 200.000€ |

Answer the questions 14, 15 and 16 (see attachments).

Comment the following statement:

“The annual budget is a global management tool”

(see attachments).

Questions

1.The forecasted production of finished product T for the first semester is (in tons):

2.Assuming the forecasted production of product T for the first semester is 50.000 tons, the forecasted production of intermediate product P1 in the same semester is:

3.Assuming the annual forecasted production of intermediate product P1 is 120.000 ton, the payments to suppliers in the first semester corresponds to:

______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

4. What is the amount to register in the forecasted Balance Sheet, in debt, regarding the social security contributions paid by the employees?

5. In the financial budget, which values should be register in each semester regarding the medium long-term loan?

6. What is the amount of financial expenses to be registered in the forecasted Income Statement?

7. Calculate the value for the department costs of the month (GR) for department D1.

8. Calculate the total departments’ variance for the Warehouse of Direct Materials (WDM).

9. Calculate the purchases variance for direct material Y is:

______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

10. Calculate the unit COGM for the month, of product ALFA, using the budgeted standard costing system:

______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

11. Calculate and justify the materials efficiency for direct material X:

______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

12. Calculate and justify the activity variance for department D2:

______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

13. Calculate the price variance for the commercial variable costs of product ALFA 1:

______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

14. Comment on the performance of the two departments.

15. Calculate and indicate at which cost of capital, the performance for the two departments will be equal, using the Residual Income (RI) measurement.

16. What other factors may condition the evaluation of comparative performance for the two departments?

Comment the following statement:

“The annual budget is a global management tool”

_________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

更多代写:美国靠谱cs网课代修机构 澳洲雅思代考 英国经济学Midterm代考 英文paper课业代写 北美essay论文作业代写 essay修改

合作平台:essay代写 论文代写 写手招聘 英国留学生代写

BUSN7031: MANAGEMENT ACCOUNTING Practice Questions 管理会计代写 1. ABC has determined that the shipment setup costs should be accounted for at the batch-level of activities. ABC believes tha...

View detailsManagement Accounting II Exam 会计考试代写 Group I (8 Values) (Estimated solving time: 60 minutes) JOTA company produces a single product from the transformation of a single product. ...

View details会计accounting代写案例去哪里找?有没有专业的机构推荐? 英国会计作业代写 在英国留学是一件非常愉快的事情,因为英国的学术氛围很好,不仅有很多著名的科学家,而且在一些领域的学术水平也在世界的前列,...

View details会计网课代修为什么这么流行?代修机构能完成老师要求么? 会计网课代修 大家都能了解到,现在很多国外留学生选择网上修习学分的这种形式,网课也越来越流行了,尤其是会计专业,现在国外的竞争也很激烈,会...

View details