国际贸易quiz代考 quiz代考 国际收支平衡表代写 国际贸易代写

485Quiz_bop 国际贸易quiz代考 1. If investment exceeds national savings, then the current account: a. must be negative. b. must be zero. c. must be positive. 1. If investment e...

View detailsSearch the whole station

国际贸易测试代写 1. The idea that with frictionless trade all goods traded internationally will have the same equilibrium price no matter which currency they are

The idea that with frictionless trade all goods traded internationally will have the same equilibrium price no matter which currency they are priced in is known as:

a. covered interest parity.

b. arbitrage.

c. the law of one price.

d. relativity.

In equilibrium, all traded goods sell at the same price internationally because of:

a. government direction.

b. arbitrage.

c. markets in which buyers and sellers do not interact.

d. the fact that the underlying value is the same everywhere.

The law of one price works under some assumptions. Which of the following is NOT an assumption for the law of one price?

a. There is free competition.

b. There is no transportation cost.

c. There are no tariffs.

d. The skill level of workers is identical in both countries.

4.

If an automobile costs $32,000 in New York and $1 = 0.8 euros, then under the condition of the law of one price, the cost of the automobile in Rome should be:

a. 32,000 euros.

b. 40,000 euros.

c. 35,000 euros.

d. 25,600 euros.

When the price of a good in the United States is $2, while in Spain it is €2, and the nominal exchange rate is E$/€ = 1.5, what is the relative price of the good in Spain versus the United States?

a. 1

b. 1.5

c. 2/3

d. 1/2

Purchasing power parity exists when:

I. there are no arbitrage opportunities.

II. prices are the same when expressed in a common currency.

III. the goods in question are identical.

a. I only

b. I and II only

c. II and III only

d. I, II, and III

In equilibrium, all traded goods sell at the same price internationally. If the same goods are expressed in their home prices, then the ratio of the prices is equal to:

a. one.

b. zero.

c. the rate of interest.

d. the nominal exchange rate between the two currencies.

While the law of one price relates prices on individual goods to the exchange rate, the theory of PPP relates:

a. the relative price level of a basket of goods to the exchange rate.

b. prices of individual goods to consumer demand.

c. exchange rates to interest rates.

d. goods markets to the market for services.

If a basket of goods in the United States costs $1,000, and the same basket of goods in Japan costs ¥125,000, then for PPP to exist, $1 should trade for ____ Japanese yen.

a. 4

b. 50

c. 125

d. 125,000

If a pair of Nike shoes cost $45 in New York and $65 in Berlin, then we would expect the price to:

a. drop in New York and increase in Berlin.

b. remain the same in both places.

c. increase in New York and decrease in Berlin.

d. increase in Berlin and stay constant in New York.

Absolute purchasing power parity implies that:

a. the price of a basket of goods is cheaper in one country than in another.

b. the price of a basket of goods is more expensive in one country than in another.

c. the price of a basket of goods is the same in the two countries.

d. the exchange rate is artificially held constant.

The nominal exchange rate between two currencies tells us:

a. changes in the exchange rate over time.

b. how many units of one currency can be purchased with one unit of the home currency.

c. how much in terms of goods and services the home currency will buy in the foreign nation compared with the home nation.

d. how much depreciation or appreciation has occurred in the home exchange rate.

The real exchange rate between two currencies tells us:

a. changes in the exchange rate over time.

b. how many units of one currency can be purchased with one unit of the home currency.

c. how much in terms of goods and services the home currency will buy in the foreign nation compared with the home nation.

d. how much depreciation or appreciation has occurred in the home exchange rate.

If a real exchange rate depreciation occurs, which of the following results?

a. It takes more home goods to purchase the same quantity of foreign goods.

b. It takes fewer home goods to purchase the same quantity of foreign goods.

c. The nominal exchange rate has risen as well.

d. The nominal exchange rate has fallen.

If the prices of goods in Europe increase, while the nominal exchange rate between the euro and the U.S. dollar remains the same, we say that the U.S. dollar has experienced a:

a. nominal appreciation.

b. nominal depreciation.

c. real appreciation.

d. real depreciation.

If more home goods are required to buy the same amount of foreign goods, then we say that foreign currency has experienced a:

a. nominal appreciation.

b. nominal depreciation.

c. real appreciation.

d. real depreciation.

When the law of one price holds for all goods and services, the real exchange rate is always equal to:

a. one.

b. the nominal exchange rate.

c. relative prices across countries.

d. 1/nominal exchange rate.

In equilibrium, with purchasing power parity, the nominal exchange rate will be equal to:

a. the two nations’ real exchange rate.

b. the ratio of the two nations’ GDPs.

c. the ratio of the two nations’ price levels.

d. one.

The data on exchange rate and price-level fluctuations in the United States and the United Kingdom from 1975 to 2010 suggest that:

a. absolute and relative PPP hold in the long run.

b. absolute and relative PPP hold in the short run.

c. absolute and relative PPP do not hold in the long run.

d. It is impossible to determine the relationship between inflation and exchange rates between the two nations.

Which of the following statements is NOT a reason for explaining the deviations from PPP?

a. Some goods are not tradeable.

b. Markets are imperfect and there could be legal obstacles.

c. Prices can be sticky in different countries.

d. There are no transportation costs.

How could conditions of imperfect competition explain deviations from PPP?

a. Imperfect competition means that prices are higher than costs and may not converge.

b. Governments often restrict trade in those goods.

c. Goods sold under conditions of imperfect competition are often inferior.

d. Arbitrageurs do not recognize profit opportunities in these markets.

What is the Big Mac Index?

a. It is a price index for the top 20 stocks traded internationally.

b. It reflects inflation trends through trade in laptop computers and international price competition.

c. It is an index of the price of McDonald’s hamburgers quoted in one currency designed to measure whether absolute PPP holds for Big Macs.

d. It is a measure of unemployment in the service industries of poor nations where Western retailers such as McDonalds have infiltrated.

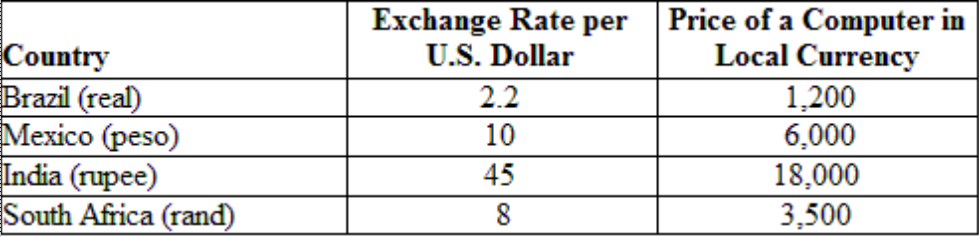

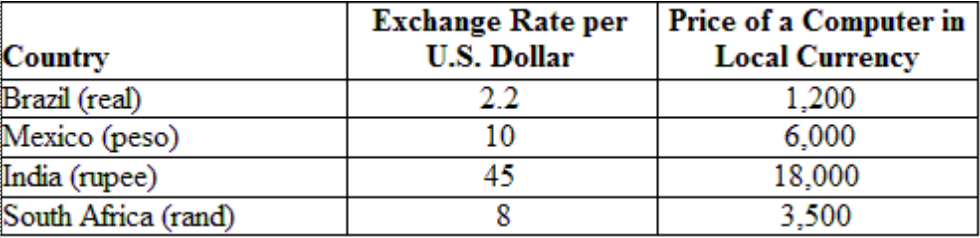

(Table: Exchange Rates and Prices) Suppose a computer costs $500 in the United States. If PPP were to hold at the given nominal exchange rate, then the price of a computer in Mexico would be _____ pesos.

a. 500

b. 50

c. 5,000

d. 0.02

24.

(Table: Exchange Rates and Prices) Suppose a computer costs $500 in the United States. With the price of the computer given in the local currency, the South African rand is _______.

a. undervalued by 12.0%

b. overvalued by 3.0%

c. undervalued by 12.5%

d. undervalued by 1.25%

更多代写:Cs Proctoru 可以作弊吗 ielts indicator代考 英国学校会查IP地址吗 Expository Essay代写 persuasive writing特点 国际贸易期中代考

合作平台:essay代写 论文代写 写手招聘 英国留学生代写

Quiz_bop 国际贸易quiz代考 1. If investment exceeds national savings, then the current account: a. must be negative. b. must be zero. c. must be positive. 1. If investment e...

View detailsInternational Trade CAS EC 391 国际贸易期中代考 QUESTION 1. The Ricardian Model of Trade I. 50 POINTS. There are two countries, the United States of America (USA) and China (CHN). QUESTION...

View detailsInternational trade final ASSESSMENT 国际贸易代写 Question 1 Discuss the economic cost and benefits for a country joining the EU (European Union). [10 marks] Question 2 Consider a model where ...

View details