国际贸易期末代考 Economics 3352代写 经济学国际贸易代写

Economics 3352, International Trade

Final Exam

国际贸易期末代考 Instructions 1. Your answers to this exam are due by 6:00pm, Eastern Time, on April 19, 2022. Upload a legible pdf of your answers to owl.

Instructions

1. Your answers to this exam are due by 6:00pm, Eastern Time, on April 19, 2022. Upload a legible pdf of your answers to owl. If your exam is received between 6:01- 6:15pm, it will be penalized by 10 points. If it is received after 6:15pm, it will not be accepted.

2. You must complete this exam by yourself, without consulting anyone else during the exam time window (2pm-6pm Eastern Time).

3. Show all of your work.

4. Read the questions carefully and answer only what is being asked.

Question 0 – Honour pledge [5 points] 国际贸易期末代考

Please write out the following statement, then print and sign your name.

“I affirm that I have neither given nor received any help on this exam, and that this work is my own. I have not spoken to anyone else about this exam between 2pm and 6pm Eastern Time on April 19.”

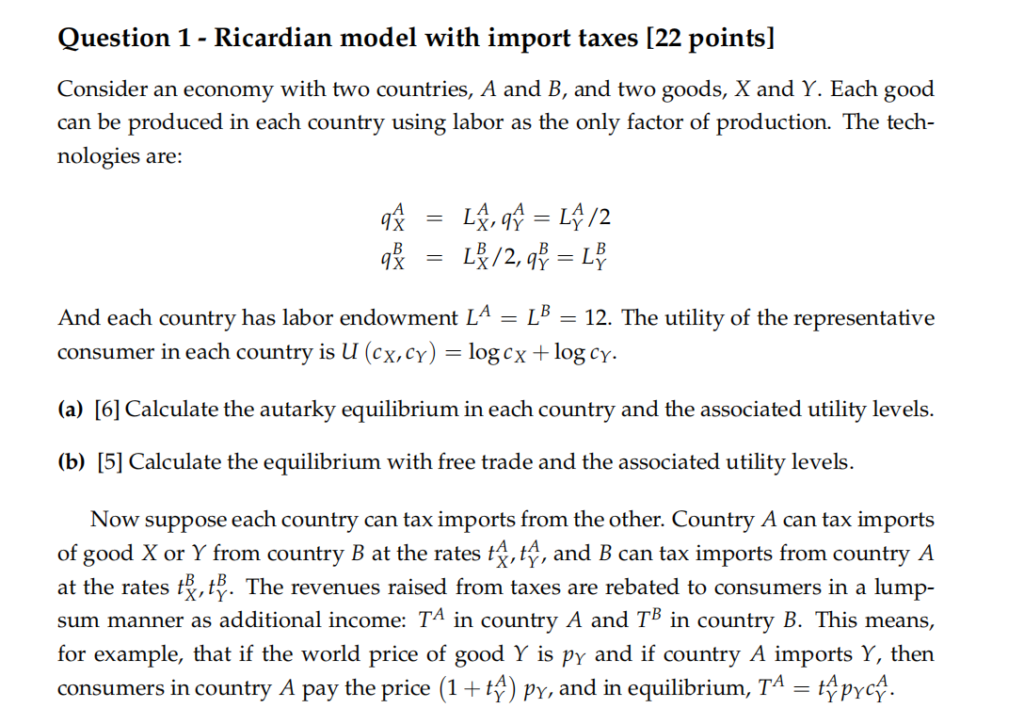

(c) [5] Calculate an equilibrium in which country A places a 50% tax on imports from country B. Compare the associated utility levels to utilities in autarky and free trade.

(d) [6] Calculate an equilibrium in which countries A and B both impose 50% import taxes on each other, and compute the associated utility levels. Compare your answers to parts (a), (b), and (c), and explain what these comparisons mean. What do these calculations tell you about the outcomes you would expect to see if two governments acting in their citizens’ interests set trade policies?

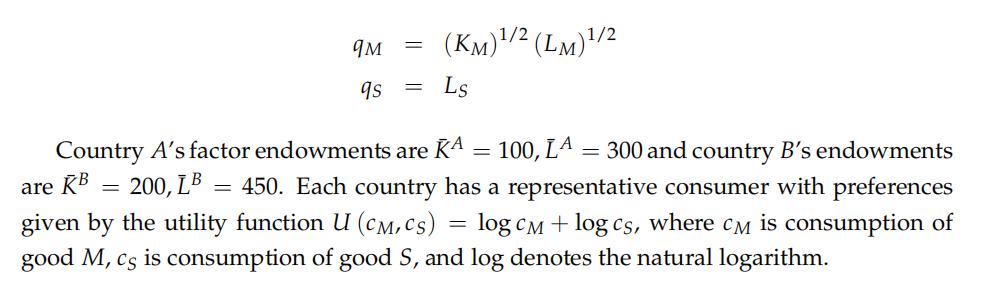

Question 2 – H-O model [20 points] 国际贸易期末代考

Consider an economy with two countries (A and B), two industries, manufacturing (M) and services (S), and two factors of production, capital and labor (K and L). The production functions in each country are

(a) [3] Which country is relatively abundant in each factor? Which industry uses each factor relatively intensively?

(b) [6] Compute the autarky equilibrium in each country.

(c) [6] Compute the free trade equilibrium for country A. Interpret the representative consumer in each country as being split into one capital owner and one worker. Who gains and who loses from trade in country A? How much of their income would the winner be willing to pay to avoid autarky and stay in free trade?

(d) [5] Some people argue that international trade can act as a substitute for migration. For example, one argument in favor of the North American Free Trade Agreement (NAFTA) in the 1990s was that it would reduce incentives for illegal migration.

Based on the H-O model, would you agree with this? Illustrate why or why not as precisely as you can, using your calculations from parts (b) and (c) above (and any additional calculations you see fit).

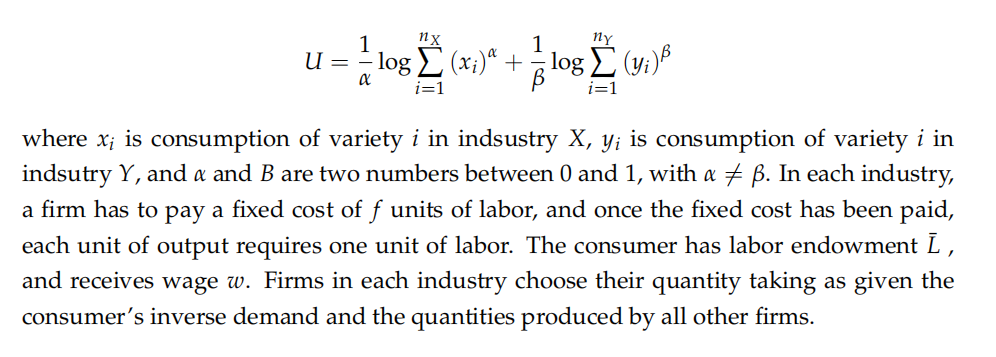

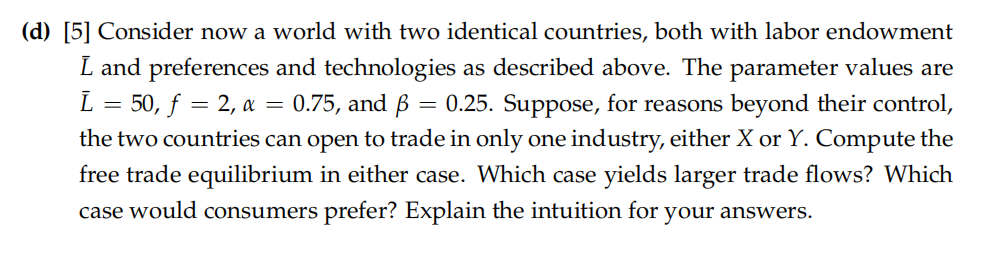

Question 3 – Two manufacturing industries [20 points] 国际贸易期末代考

Consider a version of the Krugman model with two manufacturing industries, X and Y. In each industry, there are a variety of differentiated goods indexed by i = 1, . . . , nX and i = 1, . . . , nY. A representative consumer has preferences

(a) [4] Write the consumer’s problem and derive the inverse demand function for consumption of a particular good in each industry.

(b) [5] Calculate the elasticities of substitution between two goods in industry X; between two goods in industry Y, and between a good in X and a good in Y.

(c) [6] Calculate the autarky equilibrium, making sure to compute the price, quantity, and number of firms in each sector. Normalize the wage to 1.

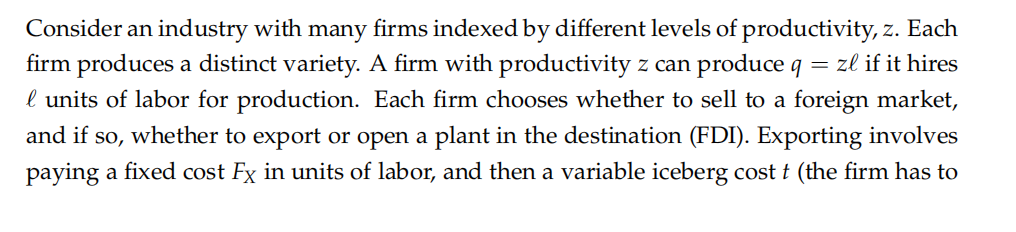

Question 4 – FDI vs. exporting model [18 points] 国际贸易期末代考

produce 1 + t units of output to sell 1 unit in the destination). FDI involves paying a fixed cost FI and no iceberg cost. Each firm faces demand in the foreign country described by the inverse demand function

p = Aq–ε

where ε > 0 and A is a constant. The wage is equal to 1 in each country.

(a) [6] Calculate an expression for the optimal price, quantity, and profit from foreign sales if the firm exports.

(b) [6] Calculate an expression for the optimal price, quantity, and profit from foreign sales if the firm does FDI.

(c) [6] Which firms export? Which firms do FDI? Which firms do neither? How do the productivity and foreign sales of firms that do FDI compare to firms that export?

Question 5 – Comparative advantage and returns to scale [15 points] 国际贸易期末代考

(a) [5] Explain the similarities and differences in how the concept of comparative advantage appears in the Ricardian and Heckscher-Ohlin (H-O) models.

(b) [5] The Ricardian and Heckscher-Ohlin models predict that: (1) Two countries are more likely to trade more if they are different; and (2) Countries gain from trade by specializing (completely or incompletely) in different industries. Are these two predictions broadly consistent with data on international trade?

(c) [5] Consider a world with a total of one million people (labor) and one million machines (capital). There are two countries in this world. For the H-O model and for the Krugman model, provide a ranking of the three scenarios by the volume of international trade predicted by each model, and explain your answers. [For the Krugman model, suppose a machine and a person are interchangeable].

1. Each country has half a million people and half a million machines.

2. There is a big country and a small country. The big country has twice as many people and twice as many machines as the small country.

3. One country has twice as many machines and half the number of people as the other country.

更多代写:html程式代写 gmat线上考试作弊 英国宏观经济online quiz代考 环境论文代写 research proposal怎么写 高等微观经济学代写

合作平台:essay代写 论文代写 写手招聘 英国留学生代写

作业代写

作业代写