财务会计代写 FINANCIAL ACCOUNTING代写

707FINANCIAL ACCOUNTING II MsC in MANAGEMET / FINANCE AND ACCOUNTING FINAL EXAM 财务会计代写 INFORMATION 1.The duration of the exam is 2 hours and 30 minutes. 2.The exam must be performed ...

View detailsSearch the whole station

财务会计考试代考 (DURATION: 2.5 HOURS plus 30 minutes upload time) This examination paper consists of four questions, each worth 50 marks. Answer any TWO questions.

(DURATION: 2.5 HOURS plus 30 minutes upload time)

This examination paper consists of four questions, each worth 50 marks.

Answer any TWO questions.

Do not submit answers to more than two questions. The examiner will mark the answers to the first two questions submitted.

Your answers must be typed and saved with the filename AcF 311 Exam 2021 as a pdf. Please include your student number and the number of the questions you have attempted in the filename. For example: AcF 311 Exam 2021 – student number – Q1 and Q3.

Include your student number at the top of your answers.

The examiner will take account of the way in which answers are presented. Ensure that the start and end of each question is clearly identifiable.

The use of standard calculators with scientific, and standard arithmetic and statistical functions, is permitted.

The exam is open-book.

Word limits: Maximum word limits are given for relevant discursive sections.

File size limit: 40Mb (N.B. please note that embedded photographs can be very large.)

ANSWER ALL PARTS OF THIS QUESTION

Amiram et al. (2018) start their definition of financial reporting fraud with: “[…] fraud is a combination of multiple elements. The most basic of these are that (i) there must be a misrepresentation in the form of a misstatement, misreporting, or omission; (ii) that misrepresentation must be material; (iii) the person making the misrepresentation must have done so with some fault in the sense that the material misrepresentation was committed negligently, recklessly, or with knowledge of its falsity […]” [Amiram, D., Bozanic, Z., Cox, J. D., Dupont, Q., Karpoff, J. M. and Sloan, R. (2018). Financial reporting fraud and other forms of misconduct: A multidisciplinary review of the literature, Review of Accounting Studies 23(2): p. 733]

REQUIRED:

i) Rephrase the above definition in your own words. [3 marks]

ii) Explain how financial reporting fraud is related to earnings management. To do so, first set out a definition of earnings management and then explain its relation to financial reporting fraud. [6 marks]

Maximum word limit for part a) = 405 words

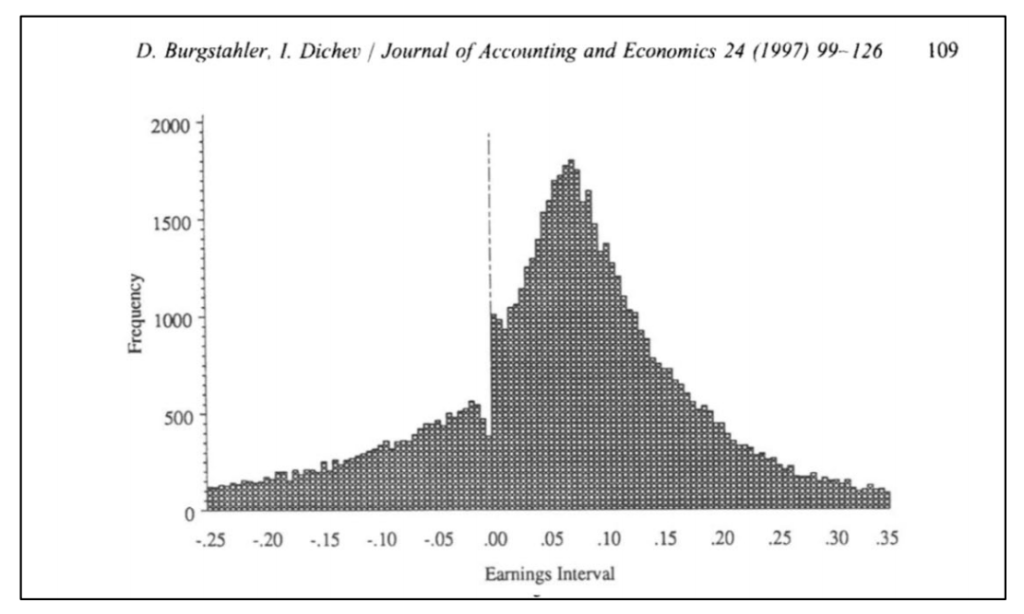

The below figure is Figure 3 from Burgstahler and Dichev [Burgstahler, D. and Dichev, I. (1997). Earnings management to avoid earnings decreases and losses, Journal of Accounting and Economics 24(1): p. 109]. Earnings are computed as annual net income over beginning-of-the-year market value.

REQUIRED:

i) Describe the figure. [2 marks]

ii) Explain why this figure can be considered evidence that supports the existence of earnings management in practice. [4 marks]

iii) Explain the objective that likely underlies the earnings management activities illustrated in the figure. [4 marks]

Maximum word limit for part b) = 450 words

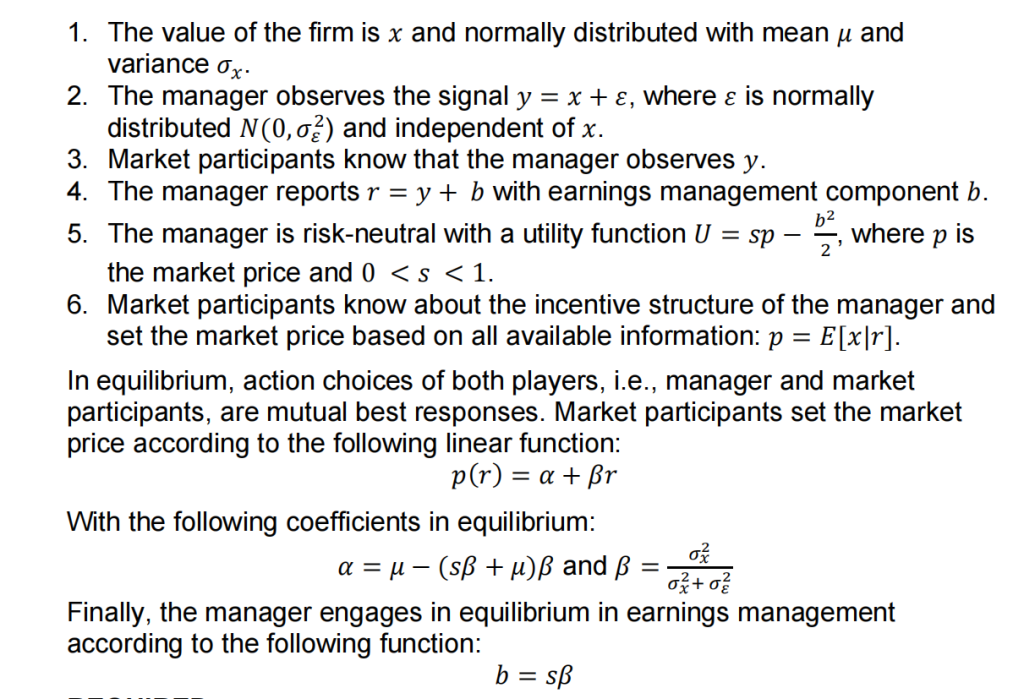

A rational expectations model for earnings management could be based on the following assumptions:

REQUIRED:

i) Discuss whether assumptions 1, 2 and 4 are plausible in a real world setting. [6 marks]

ii) Provide an interpretation of the equilibrium pricing function. To do so, first reformulate the equilibrium function by using the above expressions and rearranging terms. Then explain how market participants set the market price of the firm. [10 marks]

Maximum word limit for part c) = 720 words

“In these models, the inability to undo the earnings management is due to asymmetric information; typically, the manager knows some things which others do not. Therefore, an additional condition which must be met for earnings management to exist in an analytic model is that the asymmetry in information persists; one assumption that permits this persistence is a form of blocked communication that cannot be eliminated by changing the contractual arrangements.”

[Schipper, K. (1989). Commentary on earnings management, Accounting Horizons 3(4): p. 95-96]

REQUIRED:

Schipper (1989) emphasizes the importance of the assumption of blocked communication in analytical models. Explain whether this assumption is likely to be fulfilled in a real-world setting. You can, but do not have to, refer to arguments from Schipper (1989). [15 marks]

Maximum word limit for part d) = 675 words

Total for Question 1: 50 marks

ANSWER ALL PARTS OF THIS QUESTION

Financial accounting regulation has three components: written rules, their implementation and enforcement.

REQUIRED:

i) Explain why financial accounting is usually regulated and not left to market forces. [6 marks]

ii) Explain the terms ‘written rules,’ ‘implementation’ and ‘enforcement’ by means of an example. You will not receive marks if you reproduce examples discussed in the lecture (recordings) and/or workshop. [4 marks]

iii) Explain which component(s) of financial accounting regulation is (are) addressed by IFRS harmonization. [2 marks]

iv) Discuss two potential reasons for differences in financial accounting regulation that we observe in practice. [5 marks]

Maximum word limit for part a) = 765 words

“Facilitating comparability of financial statements is an important element of the Accounting Consensus […] Consider two companies: Company A that spends $1 million on R&D and manages to get a patent of doubtful value; and Company B that also spends $1 million on R&D and manages to develop a patent whose market value is estimated by the firm to be $10 million. Consider two possible standards: X that allows firms to capitalize that part of the R&D cost that does not exceed the firm’s estimate of the value of the R&D; and Y that requires the firm to treat all R&D outlays as expense when incurred.

Under Standard X […], to the user of the statements the two companies could look the same when their underlying states are entirely different […] Under Standard Y, both firms must expense the $1 million outlay against the current period income, and their balance sheets and income statement for the year would be identical (other things being the same) when, in fact, their underlying economic situations are quite different.” 财务会计考试代考

[Sunder, S. (2009). IFRS and the accounting consensus, Accounting Horizons 23(1): p. 104-105]

i) Sunder (2009) uses the above example to demonstrate that comparability is often not achieved through accounting standards. Explain why his example is appropriate when comparability is defined in line with the Conceptual Framework of the IASB. [5 marks]

ii) Discuss which of the remaining enhancing qualitative characteristic(s), as defined in the Conceptual Framework of the IASB, might favour an accounting rule such as Standard Y, as opposed to Standard X, in the above example. [5 marks]

iii) Discuss which of the fundamental qualitative characteristic(s), as defined in the Conceptual Framework of the IASB, might favour an accounting rule such as Standard Y, as opposed to Standard X, in the above example. [8 marks]

Maximum word limit for part b) = 810 words

Zeff and Nobes [Zeff, S. A. and Nobes, C. W.(2010). Commentary: Has Australia (or any other jurisdiction) ‘adopted’ IFRS?, Australian Accounting Review 20(2): 178-184] conclude that firm compliance with IFRS as issued by the IASB varies greatly across countries that supposedly adopted IFRS.

REQUIRED:

Discuss different reasons for the variation in firm compliance with IFRS. You can, but do not have to, refer to arguments from Zeff and Nobes (2010). You can use examples to illustrate your points. [15 marks]

Maximum word limit for part c) = 675 words

Total for Question 2: 50 marks

ANSWER ALL PARTS OF THIS QUESTION

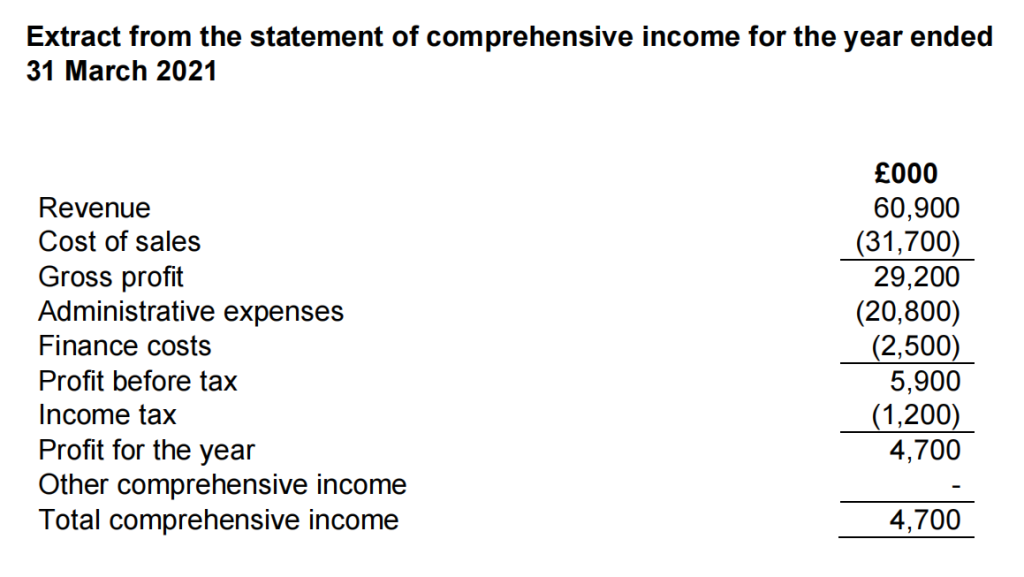

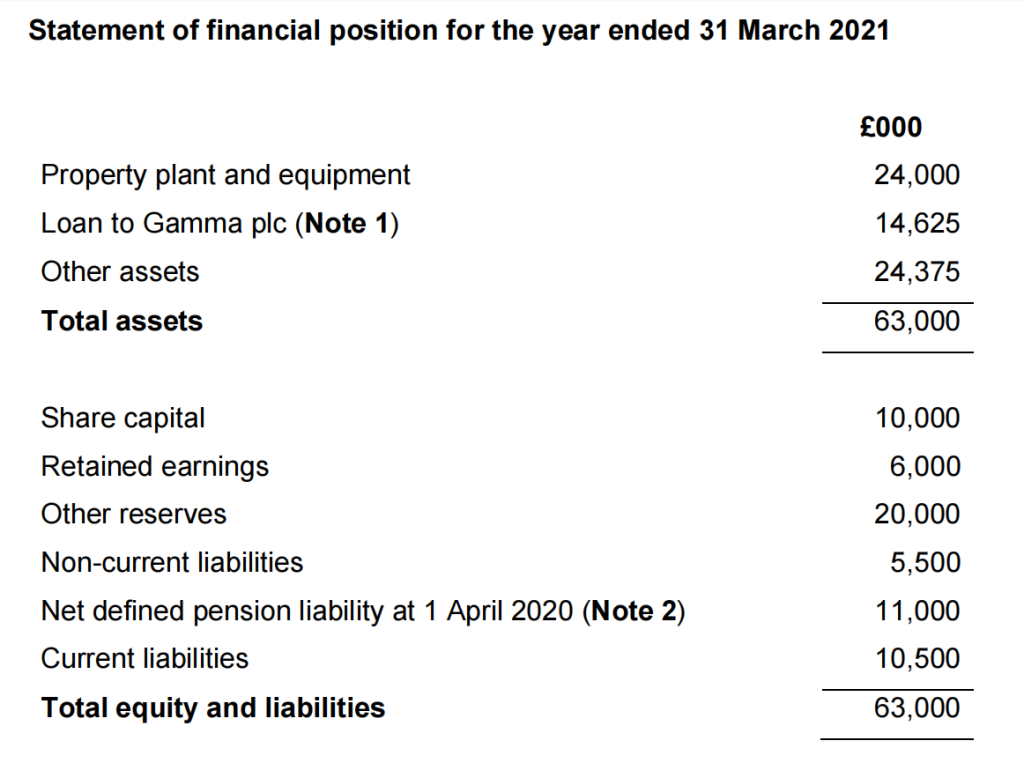

JUP plc operates in a variety of industries. JUP plc use the pound (£) as its functional currency. Set out below are draft extracts from JUP plc’s financial statements for the year ended 31 March 2021:

The following notes relate to unresolved financial reporting issues:

On 31 March 2020, JUP plc made a secured loan of £15,000,000 to a supplier, Gamma plc. The loan has an annual interest rate of 8% and is repayable in full on 31 March 2023. The loan objective is achieved by collecting contractual cash flows.

On 31 March 2020, the loan had a low credit risk and the probability of default in the next 12 months was 2.5%. An impairment of £375,000 was recognised.

On 1 March 2021, a credit rating agency indicated that Gamma plc was experiencing financial difficulty and its credit rating was lowered as there was a significant increase in credit risk. The expected credit losses over the remaining life of the loan were estimated at £2,000,000.

No adjustments have been made in the financial statements for the year ended 31 March 2021 to reflect the information received from the credit rating agency on 1 March 2021.

JUP plc operates a defined benefit pension scheme for its directors and senior management. JUP plc calls this pension scheme – Pension Scheme A. On 1 April 2020, JUP plc had a net pension liability of £11 million in respect of the Pension Scheme A. This balance represents the difference between the fair value of the pension scheme assets of £18 million, and the present value of the pension scheme obligations of £29 million.

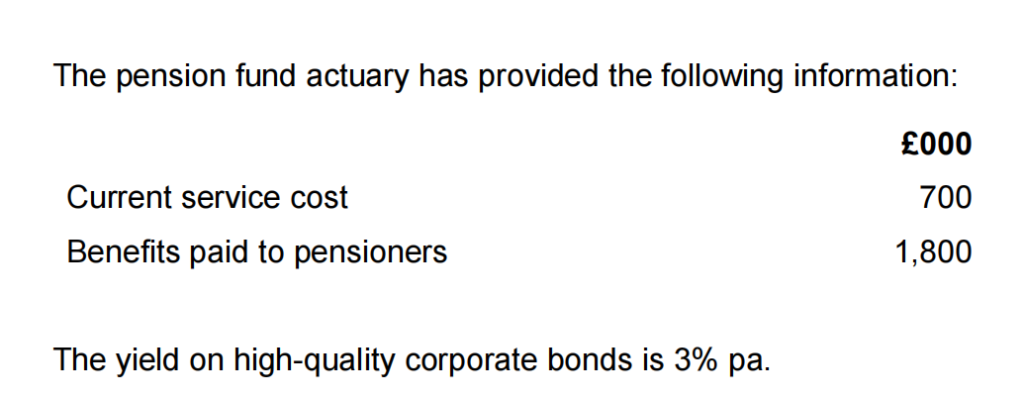

The following information has been provided by the pension fund actuary for Pension Scheme A:

The trustees of the Pension Scheme A made an offer to its pensioners to exchange future pension increases for a higher current pension, which would then remain constant. On 1 March 2021, this offer was accepted by the pensioners and this resulted in a past service gain of £2 million.

The present value of the scheme liabilities at 31 March 2021 is £27.2 million, which includes the impact of the offer and its acceptance. The fair value of the scheme assets at the same date is estimated to be £22 million.

On 1 April 2020, JUP plc started a new pension scheme which is open to all its employees. JUP calls this pension scheme – Pension Scheme B. This scheme is a separately constituted retirement benefit plan for its employees who are not members of Pension Scheme A. JUP plc and the employees both pay contributions into the plan. Contributing to the scheme entitles the employees to the right to a specific portion of the plan assets which can be used to buy an annuity on the employee’s retirement. The employees have no right or recourse to the employer if the level of funding for their retirement is not met.

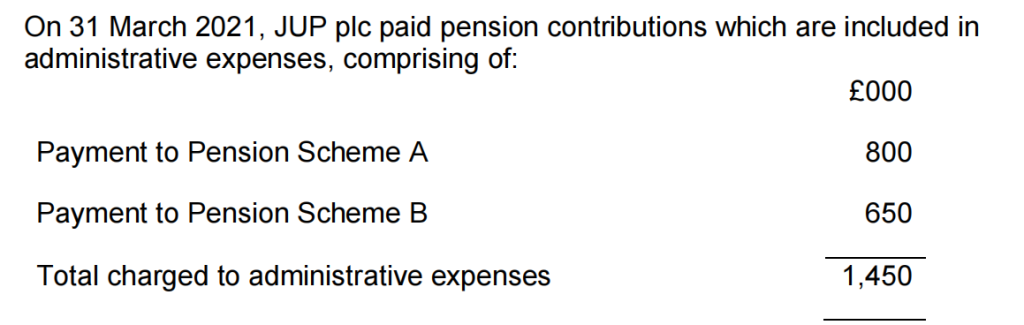

Pension contributions for Pension Scheme A and Pension Scheme B

Other than recording the cash payment for the contributions, no adjustments have been made in the financial statements for the year ended 31 March 2021 in respect of either Pension Scheme A or Pension Scheme B.

a) Set out and explain the correct financial reporting treatment in the JUP plc financial statements for the year ended 31 March 2021 for:

• the loan to Gamma plc (Note 1); and

• the Pension Scheme A and B (Note 2).

Show all journal entries required to correct the financial statements for the year ended 31 March 2021. (20 marks)

b) Prepare, including your adjustments above, a revised statement of comprehensive income and a revised statement of financial position at 31 March 2021 for JUP plc. (15 marks)

c) Evaluate the difference between the financial reporting for Pension Scheme A and Pension Scheme B. You should refer to relevant financial reporting standards, accounting concepts and academic articles. (15 marks)

Maximum word limit for part a) and c) = 1,575 words

Total for Question 3: 50 marks

Ignore any adjustments for current and deferred taxation

ANSWER ALL PARTS OF THIS QUESTION

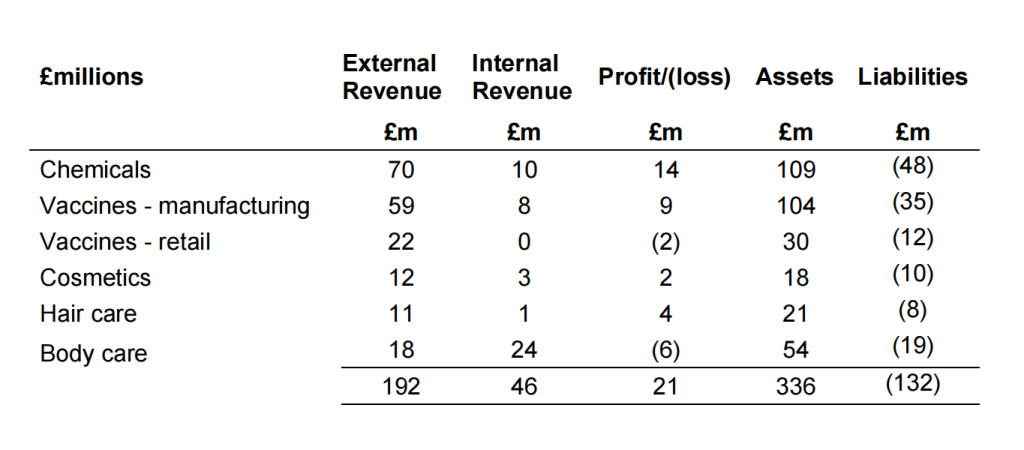

Evac plc is a multinational company in the pharmaceutical industry which trades in six business areas. The results of these business areas for the year ended 31 March 2021 are as follows:

Evac plc uses the six business areas in its internal accounts to report to the chief operating decision maker.

For the purpose of reporting to the chief operating decision maker, Evac plc excludes head office administration costs of £5 million and net interest of £1.6 million from the figure for profit as reported in the statement of profit or loss. These costs are not included in the above table

Head office assets of £150 million and liabilities of £175 million are also not included in the above table.

Evac plc’s assets are all located in the UK. 50% of its external revenue is in respect of customers in the UK, 15% in Europe and 35% in the US.

a) Identify and explain which of the six business areas are reportable operating segments for Evac plc under IFRS 8 Operating Segments for the year ended 31 March 2021. (20 marks)

b) Prepare a note showing the disclosure of Evac plc’s segments suitable for publication for the year ended 31 March 2021. (15 marks)

c) Evaluate how the management approach to segmental reporting adopted by IFRS 8 improves the quality of financial information disclosed by entities. You should refer to relevant financial reporting standards, accounting concepts and academic articles and studies. (15 marks)

Maximum word limit for part a) and c) = 1,575 words

Total for Question 4: 50 marks

更多代写:CS代码编程代做 线上考试作弊技巧 英国Economy代写 Critical Essay代写 Critical Thinking留学论文写作 本科毕业论文查重

合作平台:essay代写 论文代写 写手招聘 英国留学生代写

FINANCIAL ACCOUNTING II MsC in MANAGEMET / FINANCE AND ACCOUNTING FINAL EXAM 财务会计代写 INFORMATION 1.The duration of the exam is 2 hours and 30 minutes. 2.The exam must be performed ...

View detailsFinancial Accounting II Mid-term 财务会计考试代写 ADDITIONAL INFORMATION ADDITIONAL INFORMATION 1. The Mid-term has the duration of 90 minutes. 2. Students should have their identi...

View detailsFINANCIAL ACCOUNTING II Mid-term Multiple-choice questions 财务会计考试助攻 1. Which of the following is a characteristic describing the primary quality of relevance? A. Materiality. B. ...

View detailsFinal Exam 财务会计期末代考 Question 2 Everest Foam Company (EFC) has developed and manufactured a foam mattress which is proven to last for 10 years. Question 1 Given the following i...

View details