report报告代写-怎么写report?做好这些准备工作可以事半功倍

739怎么写report?做好这些准备工作可以事半功倍 report报告代写 报告是比较常见的一种写作方式。很多留学生在面对这类命题时往往会一头雾水,无从下手。那么,怎么写report?其实只要做好这些准备工作,就...

View detailsSearch the whole station

税收和商业战略代写 Assignment is worth up to 10 points total, including bonus points (and will constitute 5% of the term grade) Note: this is an individual

Assignment is worth up to 10 points total, including bonus points (and will constitute 5% of the term grade)

this is an individual assignment; although more than one student may end up choosing the same article (subject to the “Article requirements” below), it is preferred that each student select a unique article, but in any case the report must be prepared and submitted on an individual basis. IF TWO OR MORE STUDENTS HAPPEN TO USE THE SAME ARTICLE, THEY WILL BOTH BE SCRUTINIZED CLOSELY TO ENSURE THEY ARE UNIQUE WRITE‐UPS.

Articles appear frequently in the press that report on business situations, events, transactions, law changes, etc. that have potential tax implications (directly or indirectly) on business strategies.

· Identify and evaluate a recent article in the business press that addresses tax implications on business strategies in the context of the ACC418 material.

Over the course of the term, identify an article that has strategic tax aspects, implications, and/or consequences, and prepare a one‐two page summary report on the article. See “Article requirements” below.

Your report should at least address the following:

i. What are the strategic tax aspects and/or implications in the article?

ii. What are the taxes, costs and parties associated with the subject/content of the article?

iii. Include a clear citation for your article (publisher, author, date, etc.); also, please attach a copy of the article if at all practical.

iv. Include a brief paragraph discussing your key learning from the article.

v. Submission should be in either Word or pdf format (pdf preferred).

· Be sure to include your name somewhere on the report (yes, this actually needs to be said J…).

Although the size of the class will preclude class discussion on every article submission, some of the submitted articles will be selected for class discussion. Accordingly, after submitting your report you should also at least be prepared to briefly summarize your article and report as a starting point for class discussion should your article be selected for class discussion.

Article requirements:

· Recent publication date (no older than January 1, 2022)

· Must have strategic tax implications

· Can be from any major publication/news source (Wall Street Journal; The Economist; AP; professional journals; etc.)

· May deal with any tax‐related topic or subject touched on in the course, EXCEPT:

o The article may NOT deal with Base Erosion & Profit Shifting (“BEPS”), which will be the subject of one of the team case assignments, and

o The article may not be an article (or similar to another article dealing with essentially the same news) already discussed in class or otherwise on the Blackboard preclusion list at the professor’s discretion (a list of such precluded topics/articles will be updated on Blackboard after each class). [Note: due to this requirement, and the potential early submission bonus points mentioned below, you may want to consider completing this assignment earlier rather than later in the term…]

o If in doubt, please do not hesitate to run proposed article by me first (you can send me an email inquiry with either a copy of the proposed article attached or a link to it).

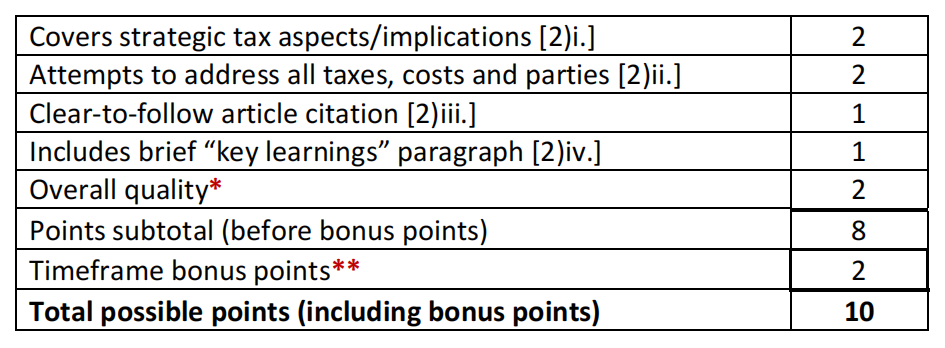

The assignment value of 10 points (with bonus points) will be determined as follows:

* Overall quality: a grade of 2 points will be awarded if a “best effort” attempt was made on the report and the report is not simply a summary/repeat of the original article. Individual assignments that do not exhibit a “best effort” or are just a summary/repeat of the article (i.e., the report appears to be “thrown together” without much effort or thought…) will receive no points for this portion of the grade.

更多代写:CS美国网课托管价格 在家考托福作弊 英国社会心理学代写 article商科代写机构 商科作文代写 sci论文代写

合作平台:essay代写 论文代写 写手招聘 英国留学生代写

怎么写report?做好这些准备工作可以事半功倍 report报告代写 报告是比较常见的一种写作方式。很多留学生在面对这类命题时往往会一头雾水,无从下手。那么,怎么写report?其实只要做好这些准备工作,就...

View details怎么写report?不会搜集材料是不是凉了? 国外report代写 在国外留学的人都会遇到一个情况,那就是关于report的写作问题。不在这个环境里的人肯定不知道这个到底指的是什么。其实report的中文翻译就是指...

View details怎么写report?report写作方法讲解 怎么写report 通常来讲report就是指学术报告的意思,听到它的名字,同学们就会明白,这种文章是较为正式的,所以在写作过程中,需要掌握格式、要求以及写作规则等事项,怎...

View details新手要怎么写report?难度很高吗?组成架构以及表达称呼指的是什么? 专业代写report 怎么写report?对于新手小白来说,这个作业难度是非常高的,就算是很多经验丰富的学长学姐也常常为这个作业感到头疼,怎...

View details