金融基础代写 FuNdamentals of finance代写 risk代写 NPV代写

602FINC12-200 FuNdamentals of finance 金融基础代写 PART A: SHORT ANSWER QUESTIONS (Four short answer questions worth 3 marks each - use dot points if necessary) Question 1: Rank in descending ...

View detailsSearch the whole station

投资组合和风险技术代写 Instructions Answers to all questions are required. Requested mathematical and all computational workings must be provided.

Answers to all questions are required. Requested mathematical and all computational workings must be provided. Tutor is unable to re-explain calculation or confirm correct numerical answers. Please make a good use of lecture exercises/solutions.

• All workings, tables and plots must be presented in ONE PDF report:

Q1 and Q2 require to provide mathematical formulae. Q1, Q2, and Q3 also need summary tables and plots. Q4 allows for handwritten workings, but can be coded/done in Excel. Copy final values and plots from Python/code output into Word/LaTeX. If you have handwritten workings – append pages to create ONE PDF file, named LASTNAME REPORT E1.

• Code computation in Python/other language but Exam One tasks can be implemented in Excel, particularly Q3 . All code/Excel to be uploaded as ONE zip file named LASTNAME CODE.zip

• Submissions in Excel only / Python notebook only will receive a deduction in marks, particularly where there is unnecessary output and where output format does not match the type requested.

Complicated submissions/multiple PDFs will result in a delay of your exam results.

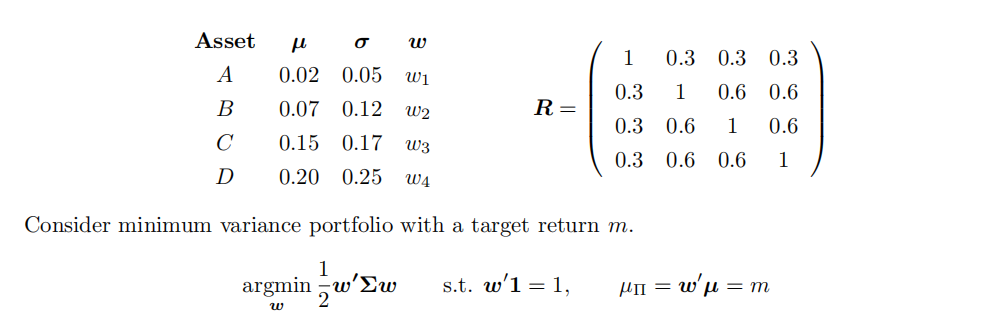

An investment universe of the following risky assets with a dependence structure (correlation) is given. Use the ready appropriate formulae from Portfolio Optimisation Lecture.

• Formulate the Lagrangian function and give its partial derivatives. No further derivation required.

• Compute the allocations w∗ and portfolio risk σΠ = √w’ Σw, for m = 4.5%.

Now, stress the correlation matrix: multiply all correlations by ×1.25 and ×1.5, and compute the respective optimal allocations and portfolio risk (the same m = 4.5%).

• Inverse optimisation: generate > 2, 000 random allocations sets w’ – these will not be optimal allocations. Plot the cloud of points of µΠ vertically on σΠ horizontally. Before computing µΠ, σΠ, you can standardise to satisfy w’ 1 = 1.

Continue with the data from Question 1 and consider a tangency portfolio.

• Formulate the Lagrangian function and give its partial derivatives only.

• For the range of tangency portfolios given by rf = 50bps, 100bps, 150bps, 175bps optimal compute allocations (ready formula) and σΠ. Present results in a table.

• Plot the true Efficient Frontier in the presence of risk-free earning asset for rf = 100bps, 175bps and specifically identify its shape.

As a market risk analyst, each day you calculate VaR from the available prior data. Then, you wait ten days to compare your prediction value VaRt−10 to the realised return and check if the prediction about the worst loss was breached. You are given a dataset with Closing Prices.

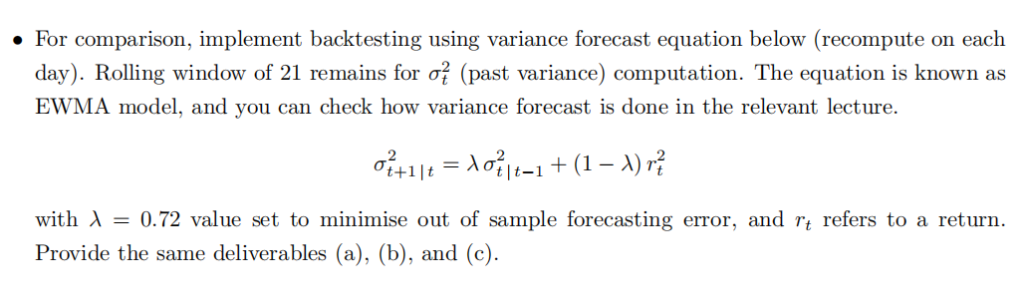

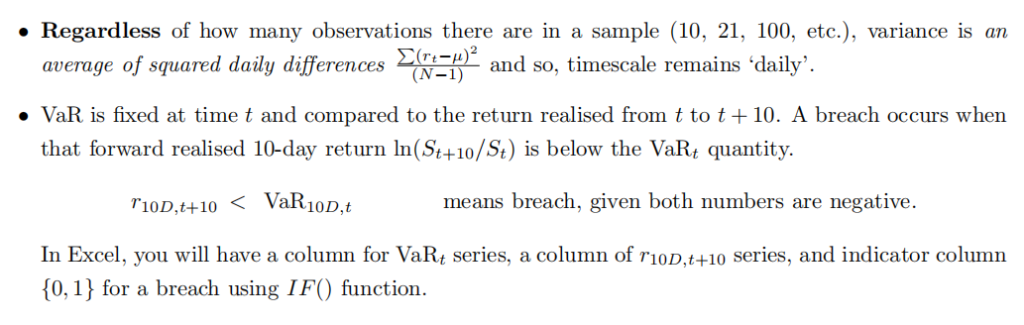

• Implement VaR backtesting by computing 99%/10day Value at Risk using the rolling window of 21 returns to compute σ. (a) Report the percentage of VaR breaches and (b) number of consecutive breaches. (c) Provide a plot which clearly identifies breaches.

VaR10D,t = Factor × σt × √ 10

Liquidity-Adjusted VaR (LVaR) is effectively VaR itself plus VaR of the bid/ask spread. The latter is our liquidity adjustment. It has not been introduced in Market Risk lecture, however to compute LVaR simply use the formula:

LVaR = VaR + ∆Liquidity

= Portfolio Value × [-µ + Factor × σ + 1/2(µSpread + Factor × σSpread)]

Use the positive value of the Standard Normal Factor for the correct percentile. For the following cases, report (a) the proportion attributed to VaR and (b) the proportion attributed to liquidity adjustment.

(a) Consider a portfolio of USD 16 million composed of shares in a technology company. Daily mean and volatility of its returns are 1% and 3%, respectively. Bid-ask spread also varies with time, its daily mean and volatility are 35 bps and 150 bps. Compute 99%/1D LVaR and attributions to it,

(b) Now consider GBP 40 million invested in UK gilts. Take the daily volatility of portfolio returns as 3% and bid-ask spread is 15 bps (no spread volatility). Compute 99%/1D LVaR and attributions. What would happen if the bid-ask spread increases to 125 bps?

Please make good use of lecture exercises particularly, Market Risk Lecture and problem-solving sessions. The tutor is unable to confirm numerical answers and methods of calculation/spreadsheets.

To compute the 99%/10day Value at Risk for an investment in the market index on the rolling basis. We drop the expected return (mean) from the VaR formula

VaR10D,t = Factor × σt × √ 10

• Appropriate Factor value to be used (Standard Normal Percentile), the tutor will not confirm the numerical value. It is also your task to identify the eligible number of observations for which VaR is available and can be backtested: Nobs will not be confirmed.

• Compute a column of rolling standard deviation over log-returns for observations 1 −21, 2−22, . . .. Compute VaR for each day t, after the initial period. This is your worst loss prediction.

• To obtain the conditional probability of breach Nconseq/Nbreaches, identify consecutive breaches. For example, the sequence 1, 1, 1 means two consecutive breaches occurred.

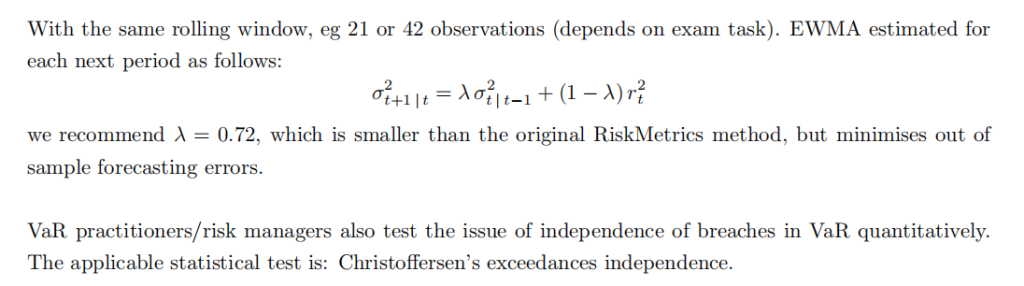

• As an extra (not a requirement), you can apply statistical tests to the issue of independence of breaches in VaR (eg, conditional coverage, Christoffersen’s exceedance independence).

Alternatively, simply provide Q-Q plots for 1D returns and conclude if Normally distributed returns was a reasonable assumption. Lecture One (Module One) solutions give instruction on Q-Q plots.

EWMA scheme for variance forecasting is a practitioner’s balance between naive sample std dev and GARCH models. The main disadvantage of GARCH(1,1) in the context of 10-day VaR is that the full GARCH model is too biased towards the long-term average variance.

更多代写:CS留学生作业修改 gre代考靠谱吗 英国力学网课托管 article理科代写 美国Course论文代写 留学生报告代写

合作平台:essay代写 论文代写 写手招聘 英国留学生代写

FINC12-200 FuNdamentals of finance 金融基础代写 PART A: SHORT ANSWER QUESTIONS (Four short answer questions worth 3 marks each - use dot points if necessary) Question 1: Rank in descending ...

View detailsCorporate Investment & Strategy 企业投资与战略代写 Question 1:It is often said that small capitalised firms are riskier than large capitalised firms, and that results in higher volatil...

View details