公司会计代写 BUSN7050代写 Company Accounting代写

624BUSN7050Company Accounting Mid-Semester 公司会计代写 Instructions To Students: · The examination paper consists of 5 sections (A, B, C, D, E) and 2 appendixes. · Answer ALL SECTION A qu...

View detailsSearch the whole station

企业会计代写 INSTRUCTIONS · The examination paper consists of 5 sections (A, B, C, D, E) and 2 appendixes. · Answer ALL SECTION A questions on the multiple choice

· The examination paper consists of 5 sections (A, B, C, D, E) and 2 appendixes.

· Answer ALL SECTION A questions on the multiple choice answer sheet provided.

· Answer ALL SECTION B, C and D questions in the booklet provided.

· Answer SECTION E questions (a) and (c) in the booklet provided and SECTION E question (b) in the worksheet provided as an additional page.

· Record your student number in the space provided on the additional page with the worksheet, on the booklet provided and the multiple choice answer sheet.

· Examination multiple choice answer sheets, booklets and the additional page without student numbers will be deemed incomplete and FAILED.

· At the end of the examination, please place the multiple choice answer sheet and the additional page examination paper inside the examination booklet.

· Narrations are not required for general journal entries.

· You are required to show your workings and state your assumptions where appropriate.

· Amounts are to be rounded to the nearest dollar.

· Total marks on paper: 100 marks.

· Weighting of the mid-semester examination for the semester: 25%

Multiple Choice Questions (1.5 marks each; 15 marks total; 15% total) – 18 minutes

You are required to answer all the questions in this section. Identify the best response to the questions and indicate the corresponding letter on the answer sheet provided.

What option(s) does a company have when directors are of the view that compliance with accounting standards does not generate “a true and fair” view financial statements?

A. Directors may elect not to comply with the standard.

B. Directors may provide additional information to this effect in the notes to the accounts.

C. Directors may exercise the “true and fair view override”.

D. Directors may elect not to comply with the standard and may provide additional information to this effect in the notes to the accounts.

Fraser Ltd issued a prospectus for 10 million shares at a price of $3 on 1 July 2014. The subscribers are required to pay $1 on application, $1 on allotment and the balance on call to be announced at a later date. The share issue was oversubscribed by 2 million shares. On 1 August 2014 the shares were allotted to all subscribers on a pro-rata basis. What is the balance of the “allotment” and “share capital” accounts for this share issue on 1 August 2014, respectively?

A. $8 million; $20 million.

B. $8 million; $30 million.

C. $10 million; $20 million.

D. $10 million; $30 million.

In the case of a share issue being oversubscribed, the common approaches include:

A. Issue additional shares to meet the excess demand.

B. Increase the issue price of the shares.

C. Issue additional shares to meet the excess demand and increase the issue price of the shares.

D. Allocate the shares on a pro-rata basis.

A central goal in establishing a conceptual framework of accounting will be to obtain general consensus on:

A. The scope and objectives of financial reporting.

B. The qualitative characteristics that financial information should possess.

C. What the elements of financial reporting are, including agreement on the characteristics and recognition criteria for assets, liabilities, income, expenses and equity.

D. All of the above answers.

Under AASB 101 the classification of assets into current and non-current will depend on the entity’s:

A. Average operating cycle.

B. Normal operating cycle.

C. Current accounting period.

D. 12 month cycle.

If an event or transaction that occurs after the end of the reporting period does not relate to conditions that existed at reporting date then:

A. No action should be taken to report the event or transaction in the financial reports.

B. The balance sheet should not be adjusted but effects on the income statement should be reflected in that statement.

C. The event or transaction should be disclosed in the notes to the accounts as a post reporting date event and the financial statements adjusted appropriately.

D. The event or transaction should be disclosed in the notes to the accounts if it is material.

The ‘participating’ in participating preference shares means that the shareholders may:

A. Vote at annual meetings.

B. Vote at annual meetings if preference dividends have not been paid.

C. Participate in a conversion of preference shares into ordinary shares.

D. Receive a share of any further profits that are to be distributed to ordinary shareholders after the payment of the preference dividend.

On 30 June 2014, Mala Ltd leased a vehicle to Tango Ltd. Mala Ltd had purchased the vehicle on that day for its fair value of $89,721. The lease agreement cost Mala Ltd $1,457 to have drawn up and requires Tango to reimburse Mala for annual insurance costs of $1,050. The amount recorded as a lease receivable by Mala Ltd at the inception of the lease under the net method is:

A. $88,264.

B. $89,721.

C. $90,771.

D. $91,178.

The generally accepted (a) accounting rule, and (b) tax rule; for development expenditure, are:

A. Capitalise and amortise; (b) A tax deduction when paid for.

B. Expense when paid for; (b) A tax deduction when paid for.

C. Capitalise and amortise; (b) A tax deduction when amortised.

D. Expense when paid for; (b) A tax deduction when amortised.

Casper Ltd incurred a tax loss of $500,000 in the year ended 30 June 2013. This was due to one-off circumstances and it is expected that Casper Ltd will obtained taxable profits in the year ended 30 June 2014 and subsequent years. There are no temporary differences in either year. In the year ended 30 June 2014 Casper Ltd obtains a taxable profit of $700,000. The tax rate is 30%. What are the journal entries for the year ended 30 June 2014?

A.

Dr Income tax expense $700,000

Cr Deferred tax asset$500,000

Cr Income tax payable $200,000

B.

Dr Income tax expense $210,000

Cr Income tax payable $210,000

C.

Dr Income tax expense $210,000

Cr Deferred tax asset $150,000

Cr Income tax payable$60,000

D.

Dr Deferred tax liability $500,000

Cr Income tax expense $200,000

Cr Income tax payable $700,000

Answer the following question in the examination booklet (10 marks, 10 % total) – 12 minutes

Describe the movements recorded (i.e. increases and decreases) in each of the ledger accounts used to account for a public issue of partly paid shares (consider the case of oversubscription and undersubscription) (10 marks – 12 minutes)

There is one problem in this section and you are required to answer ALL questions in the examination booklet. (21 marks; 21 % total) – 25 minutes

The following transactions and events took place for Freddy Ltd during the years ended 30 June 2013 and 30 June 2014:

· On 1 July 2012, Freddy Ltd issued to existing shareholders 30,000 options to buy 30,000 ordinary shares. Each option costs 50c and entitles the holder to one ordinary share at a price of $1 per share, exercisable between 1 December 2013 and 1 January 2014. By 1 January 2014, 28,000 options were exercised and the remaining have lapsed.

· Freddy Ltd issued through a private placement $200,000 of five-year, 4% per year, semi-annual coupon debentures (which pay interest every 6 months). The market requires a rate of return of 6% per year. The money came in and the debentures were allotted on 1 January 2013. 企业会计代写

· On 1 April 2013, Freddy Ltd issued through a private placement 50,000 10% preference shares with a nominal value of $2 per share. These shares can be redeemed at the request of the shareholders. The shareholders request the redemption on 30 March 2014. In order to redeem these shares, Freddy Ltd issues through a private placement 100,000 fully paid ordinary shares with a nominal value of $1.50, incurring share issue costs of $2,000 which were paid on 10 April 2014. The shares were redeemed at 30 March 2014.

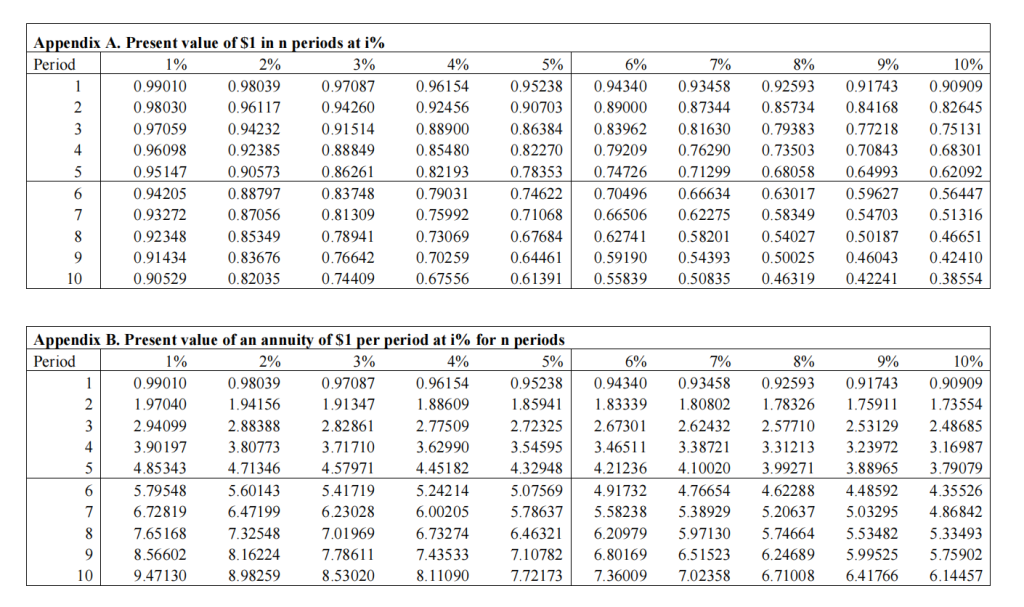

(a) Show all your workings to determine the debenture issue price and the interest

expense paid during the year ended 30 June 2014, using the effective interest method – HINT: use the appendixes at the end of this examination paper. (4.5 marks) – 5 minutes

(b) Prepare journal entries to record the above events and transactions for Freddy Ltd during the financial years ended 30 June 2013 and 30 June 2014. (16.5 marks) – 20 minutes Show all your workings and state your assumptions if necessary. Amounts are to be rounded to the nearest dollar.

There is one problem in this section and you are required to answer ALL questions in the examination booklet. (24 marks; 24 % total) – 29 minutes

Freddy Ltd enters into a non-cancellable five-year lease agreement with Toby Ltd on 1 July 2014. The lease is for a number of race karts that, at the inception of the lease, have a total fair value of $782,995. Toby Ltd manufactures the karts. The total cost of the karts to Toby Ltd is $700,000. Toby Ltd and Freddy Ltd paid $1,505 and $3,005, respectively, in costs to prepare the lease agreement. The karts are going to be used by Freddy Ltd in its go kart racing facility. The karts are expected to have an economic life of 6 years, after which time they will have no residual value. There is a bargain purchase option that Freddy Ltd will be able to exercise at the end of the fifth year, for $40,000. The lease agreement details are as follows:

Length of lease 5 years

Commencement date 1 July 2014

Annual lease payments commencing 30 June 2015 $220,000

Economic life of the karts 6 years

Bargain purchase option $40,000

Interest rate implicit in the lease 10%

All insurance and maintenance costs are paid by Toby Ltd and are expected to amount to $20,000 per year and will be reimbursed by Freddy Ltd by being included in the annual lease payment of $220,000. The karts are to be depreciated on a straight-line basis.

(a) Prove that 10% is the interest rate implicit in a lease. (3 marks) – 4 minutes

(b) Prepare the journal entries to account for the lease in the books of Freddy Ltd for the year ending 30 June 2015 (starting with the entries on 1 July 2014 to recognise the lease transaction). (6.75 marks) – 8 minutes

(c) Prepare a schedule of lease receipts for Toby Ltd. (5.25 marks) – 6 minutes

(d) Prepare the journal entries to account for the lease in the books of Toby Ltd for the year ending 30 June 2015 using the net method (including the entries on 1 July 2014). (9 marks) – 11 minutes

Show all your workings and state your assumptions if necessary. Amounts are to be rounded to the nearest dollar.

There is one problem in this section and you are required to answer questions (a) and (c) in the examination booklet and question (b) in the worksheet provided as an additional paper to this examination paper. (30 marks; 30% total) – 36 minutes

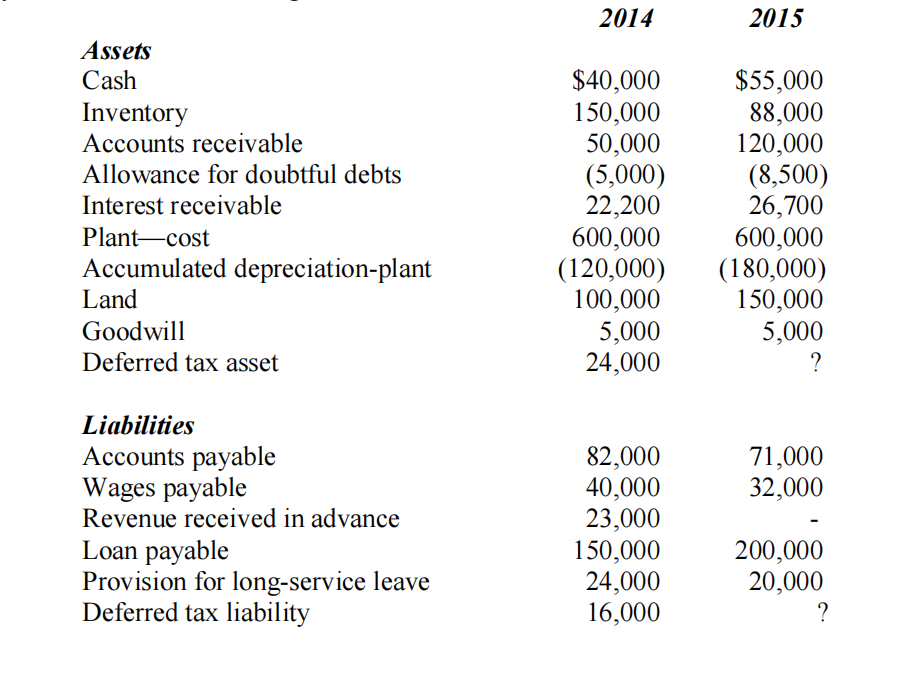

The draft statements of financial position of the company at 30 June 2014 and 30 June 2015 for Toby Ltd showed the following assets and liabilities:

· The company tax rate was 32% for the year ended 30 June 2014 and 30% for the year ended 30 June 2015. The balances of the deferred tax accounts at 30 June 2014 were calculated based on the 32% tax rate.

· During the year ended 30 June 2015, Toby Ltd received a government grant of $25,000 and incurred $5,000 in entertainment expenses.

· Amounts received from sales, including those on credit terms, are taxed at the time the sale is made. No bad debts were written off.

· Interest revenue earned during the year ended 30 June 2015 was $40,000. Only the amounts received in cash are taxed.

· The plant is depreciated on a straight line basis over 10 years for accounting purposes and over 6 years for taxation purposes. The plant is not expected to have any residual value.

· A parcel of land was acquired during the year ended 30 June 2015. The land is not expected to be sold.

· Wages expenses of $210,000 were paid during the year ended 30 June 2015. They are not deductible for tax purposes until they are actually paid.

· No revenue was received in advance during the year ended 30 June 2015.

· The long-service leave of $15,000 has actually been paid during the year ended 30 June 2015. It is not deductible for tax purposes until it is actually paid.

· There are no other items that cause differences between accounting and taxable profit. The taxable profit was determined to be $160,000.

(a) Determine the accounting profit for the year ended 30 June 2015, starting from the taxable profit before tax and showing the adjustments for differences between taxation and accounting rules. (8 marks) – 10 minutes

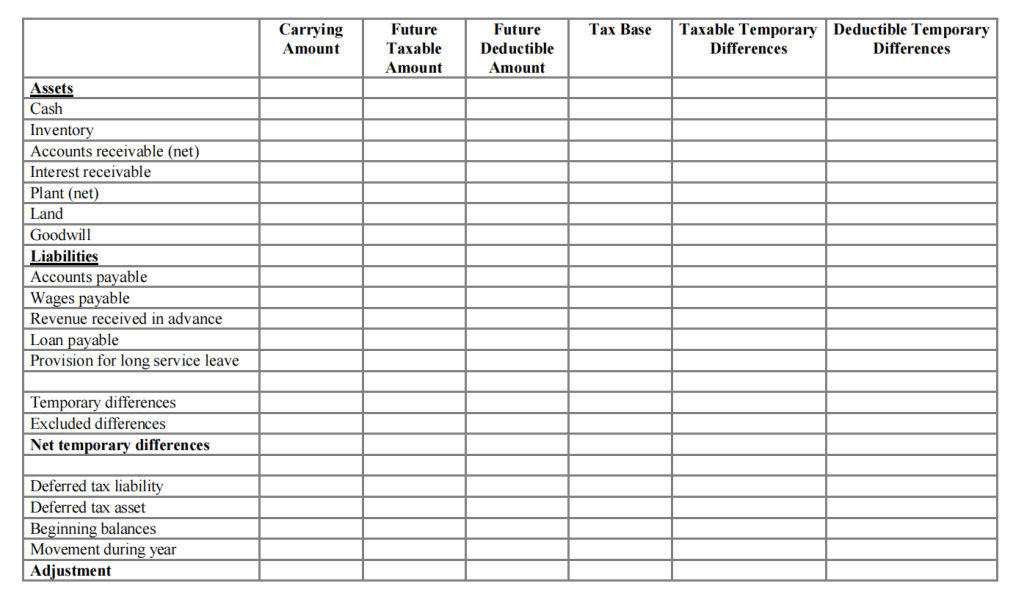

(b) Complete the worksheet on the additional page provided to determine the movements in the deferred tax accounts for the year ended 30 June 2015. (16 marks) – 19 minutes

(c) Prepare the journal entries for the year ended 30 June 2015 to account for income tax in accordance with AASB 112 “Income Taxes”, starting with the journal entry to recognise the change in tax rate. Toby Ltd does not set off the deferred tax accounts against each other. (6 marks) – 7 minutes

Show all your workings and state your assumptions if necessary. Amounts are to be rounded to the nearest dollar

更多代写:CS加拿大网课代考机构 托福线上考试 英国金融统计学代考 article加拿大物理代写 加拿大essay作业代写 gre作弊后果

合作平台:essay代写 论文代写 写手招聘 英国留学生代写

BUSN7050Company Accounting Mid-Semester 公司会计代写 Instructions To Students: · The examination paper consists of 5 sections (A, B, C, D, E) and 2 appendixes. · Answer ALL SECTION A qu...

View details